- Milwaukee County: $230,000 (+eight.3%)

- Waukesha State: $326,000 (+14.1%)

- Ozaukee State: $410,000 (+6.6%)

- Arizona County: $340,000 (+nine.2%)

- Racine Condition: $238,750 (+8.5%)

Given the aggressive character of the mortgage team, banks or other financing associations render a number of items that have made real estate easier. Mortgage loans started fixed or varying rates. Repaired pricing are usually several payment points higher than changeable rates, but the speed stays lingering on lifetime of the mortgage. He could be ideal whenever interest rates try secure or for home owners just who plan to are now living in their home for a long time. Variable- or variable-rate mortgage loans (ARMs) boost otherwise fall off towards the prevailing rates. Variable-speed mortgage loans are typically when interest rates try altering easily otherwise to own home owners whom anticipate costs https://simplycashadvance.net/payday-loans-de/ in order to decrease in next couples many years, intend to stay static in their property for 5 many years or less, otherwise try pretty sure the money will increase going forward. In order to cover people, changeable rate funds possess caps you to limitation exactly how much the pace increases throughout the years.

To purchase property

Many loan providers provides on the web worksheets in order to decide how far household you really can afford. Normally, house payments as well as insurance rates and you may assets fees shouldn’t exceed 28 % out of household terrible monthly earnings (income before taxation). Homeowners just who are unable to build a downpayment equal to 20% of your own conversion process rates will most likely need to buy private financial insurance coverage, which can put $fifty in order to more than $2 hundred towards payment per month. People should consult a real estate agent otherwise home loan banker to see which they may be able manage.

Regional Loan providers

Milwaukee has some regional lenders, including Convention Borrowing Partnership, who understand the Milwaukee business well and will offer valuable direction with home financing.

There are various advantages to in search of regional loan providers. They are aware and you will understand the local markets and will provide advice once they think an excellent seller’s pricing is too high. Suppliers and you can listing agencies instance working with regional loan providers because they discover each other. In the end, seeking a local lender is a great solution to begin a great financial relationship for people thinking of moving the bedroom.

Prequalification

Before long-time, the brand new Milwaukee market has been extremely active. Reasonable prices and you can increased need for housing provides notably reduced the newest day house are on the marketplace. In fact, this is simply not unusual having homes to possess 2 or 3 offers in the asking price or maybe more to the first-day that they’re technically on the market. This means that, potential customers have to make sure he’s that which you ready to wade after they enter the field.

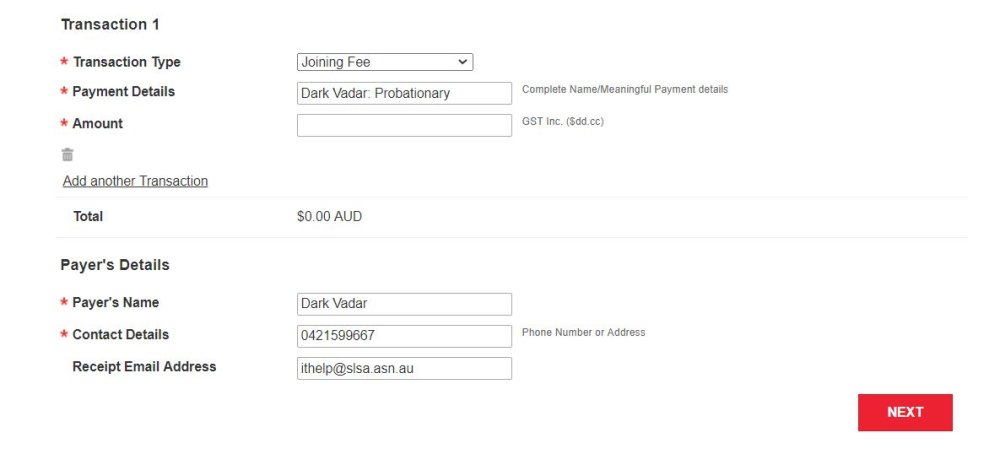

One of the better a method to ready yourself is to find pre-accredited of the a lender. The lending company will feedback your monetary ideas and you will approve that it’ll give you doing a specified number to own a home loan. Having that at your fingertips once you build your give can simplicity provider concerns over resource.

Mortgages

Mortgage loans come due to home loans, banking companies, borrowing unions and you will deals banks. If or not your elect to works really which have a loan provider otherwise because of a mortgage broker, its a good idea to score pre-qualified. This will help you definitively decide just how much you really can afford. It does give you an aggressive virtue that have sellers, because you can present them having a document exhibiting that you should be able to spend the money for matter he’s asking.

Fixed-Rate Mortgage loans

Fixed-rates mortgage loans element an interest rate you to definitely remains lingering from the longevity of the borrowed funds, and therefore generally diversity in length of ten years to 30 years.