- What your need to know about buying a foreclosed home

- How can home foreclosures really works?

- Kind of property foreclosure

- Investment good foreclosed home

- Cons of buying a foreclosed home

- Very long techniques with increased records

- Family reputation inquiries

- Battle

- Pros of buying a foreclosed home

- Package pricing

- Money solutions

- Make smart a residential property investments in partnership with Belong

You can find foreclosed house during the just about any real estate market in the united kingdom, and purchasing an effective foreclosed household has-been smoother adopting the mid-2000s financial crisis. Pursuing the moratorium on the foreclosures, in response toward COVID-19 pandemic, concluded for the , investors expected a rise in foreclosure. However, we have been however watching a restricted have and significant battle. The very best bonus inside to acquire an effective foreclosed house is can cost you, but unstable timelines, repairs, and firm battle will get deter you from to find a beneficial foreclosed home.

You will find some sorts of foreclosures: pre-foreclosures, brief profit, sheriff’s deals, bank-had, and you will bodies-owned. Most of the type of property foreclosure keeps book attributes, in addition to pick procedure may differ. Think choosing a realtor who’s always the latest property foreclosure process. They shall be able to provide you with certain sense considering its experiences.

Just how do house foreclosures functions?

Whenever a manager can no longer generate costs to their financial, the bank requires arms of the home. The financial institution usually directs a notification off standard just after 90 days off skipped costs. Often, this new homeowner comes with the opportunity to policy for another type of payment plan to the financial before house is offered. When you are to find a great foreclosed house, you are getting the domestic regarding financial, maybe not the home’s modern manager.

Kind of foreclosure

Pre-foreclosure: Since the proprietor is in default on the home loan, he or she is informed by financial. Should your resident can sell the house or property inside pre-foreclosure period, they may be able steer clear of the foreclosures procedure and lots of of your own impacts on their credit score.

Small conversion: If the a homeowner is enduring pecuniary hardship, capable to offer their house within the a primary deals. The lending company should commit to take on shorter towards possessions than new citizen currently owes on the financial. Short conversion process would be a long time due to the fact financial has to operate and you may agree the offer.

Sheriff’s profit: Sheriff’s sales are deals held after residents standard on the finance. This type of deals is facilitated by local the police, hence the name sheriff’s revenue. Within these auctions, the house comes to the highest bidder.

Bank-possessed services: When the property does not sell at auction, it becomes a bona-fide estate owner (REO) property. The borrowed funds financial, financial, otherwise mortgage individual possesses the home, and they version of attributes are sometimes also called bank-owned belongings.

Government-owned attributes: Similar to REO services, these household was first bought having fun with an FHA or Va financing, one another government-right back fund. When this type of characteristics was foreclosed and do not sell in the auction, it be regulators-owner characteristics. After that, they are ended up selling of the brokers who work with respect to the fresh new institution hence provided the mortgage.

Financing a good foreclosed house

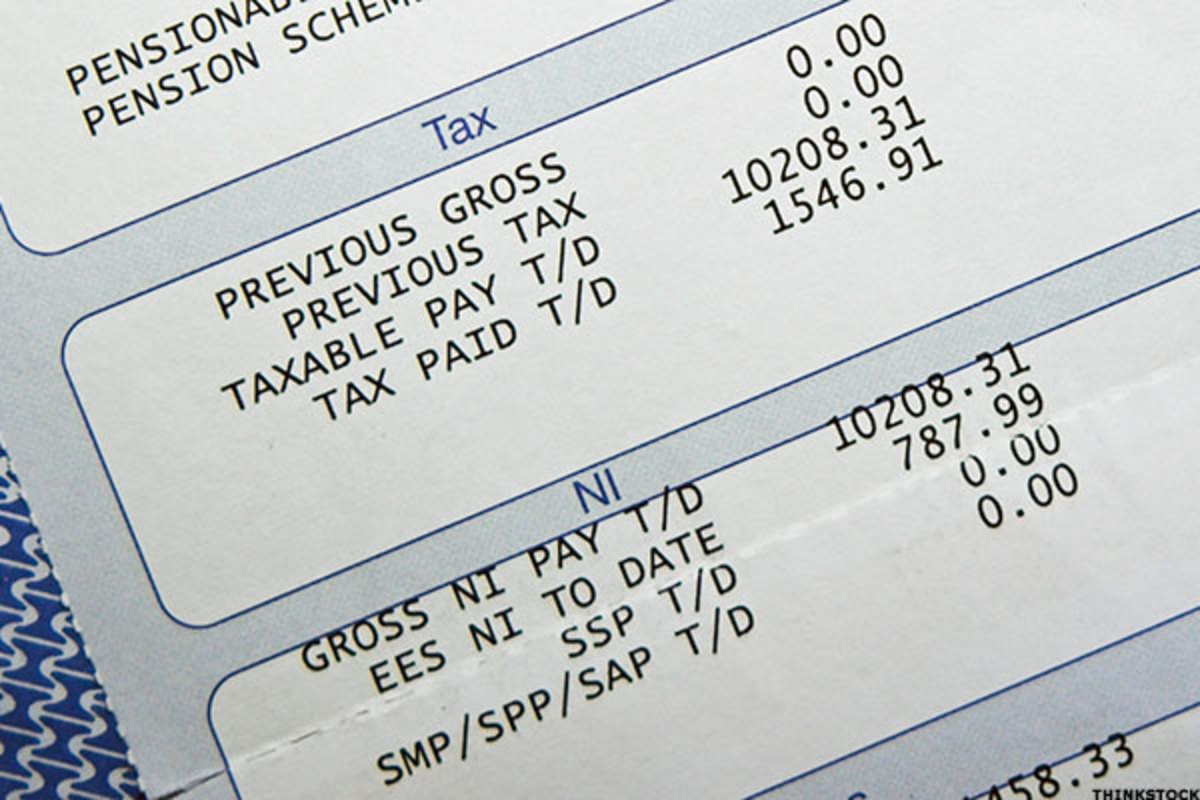

While you are all the dollars has the benefit of gives the greatest virtue whenever to shop for good foreclosed family, certain financing options are designed for investment qualities. Remember that personal lenders can be less likely to want to finance the purchase from an effective foreclosed family. So you’re able to facilitate the process, consider going for a loan provider and receiving pre-accepted to own a mortgage.

Whenever you are finding to shop for a property foreclosure, i encourage examining the regulators-paid capital options available to people exactly who qualify. A beneficial 203(k) loan is a type of financing provided with the new Federal Casing Administration (FHA). You will find some different kinds of 203(k) fund. Possible basically be charged a mortgage top so holiday loans you can offset the bank’s chance. you will find the interest levels of these kind of financing are about 0.25% greater than antique money.