- Money only become owed for the portion of the line from credit you employ.

- Straight down, interest-simply payments may be readily available for the HELOC draw several months.

- Chances of overspending with good rotating line of credit.

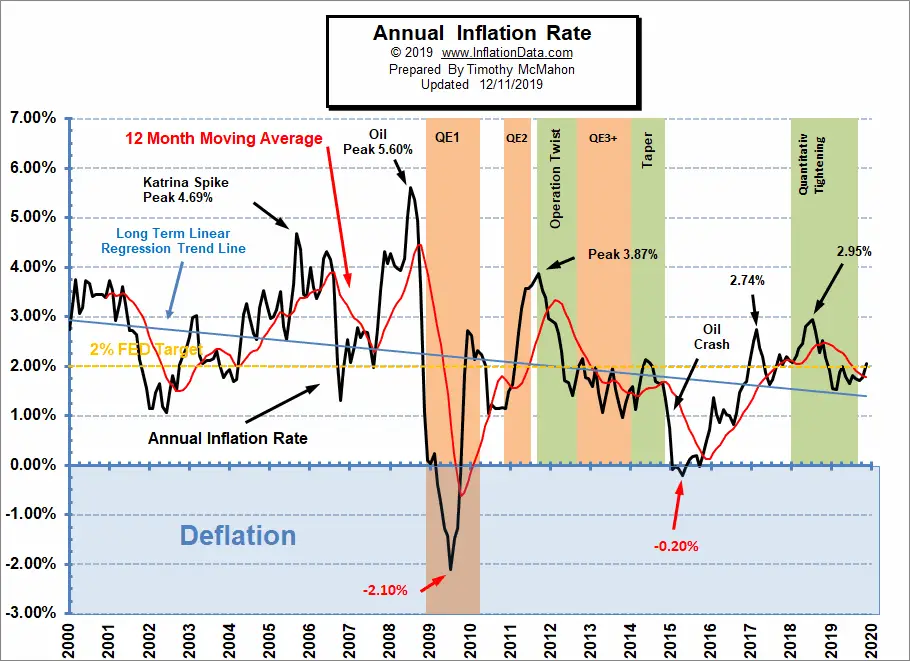

- Variable rate of interest could increase due to monetary and business conditions.

- Fluctuating monthly obligations make budgeting problematic.

At the same time, there might be home security line of credit tax experts, even though 2017 tax rules changes made so it more complicated than ever before. Simply speaking, notice with the house collateral currency lent immediately after 2017 is only taxation-allowable for buying, building, otherwise improving qualities. Because this sort of taxation rules is actually tricky, you will want to request a taxation professional before applying to have a great HELOC to choose whether you are eligible for people family security line of credit tax benefits.

What exactly is a great HELOAN?

Once you qualify for a property equity mortgage, you’ll get the borrowed funds from inside the a lump sum payment upfront. Extremely HELOANS has actually a predetermined interest, so your payment (in addition to dominating and you will desire) will continue to be a similar regarding the life of the borrowed funds.

House Guarantee Loan Benefits and drawbacks

After qualifying for a home security mortgage, you are going to discovered your loan amount since an individual lump sum and start and then make month-to-month payments instantly on entire amount borrowed. Domestic equity fund routinely have a fixed interest, definition the payment per month – including the dominant and you can attract – will remain the same about lifetime of the borrowed funds.

- Fixed month-to-month loan money promote predictability in which to help you plan and budget for now therefore the future.

- Acquiring loans from inside the a lump sum was of use for folks who decide to utilize the currency for starters or a major investment that have an expenses owed in full.

- The newest repaired interest rate cannot change that have field conditions through the living of your own financing.

- Family security loan payments begin right now.

- Payments was computed for the whole lent lump sum payment amount if or otherwise not you use it all.

While provided good HELOC vs. household equity loan, consider the matter which you actually need. If you’re not sure just how much you will be spending but wish to be in a position to cover unanticipated costs that can happen over several years of your time, a beneficial HELOC could be the most readily useful fit for your role. In the event you you will have to draw currency over the years, like with a long-term venture otherwise more substantial lingering expenses, a great HELOC is generally right for you. A HELOC plus will give you the flexibility so you’re able to borrow just the wide variety you need and you will pay back those people wide variety because you wade.

Whenever try a beneficial HELOAN the best option?

An effective HELOAN is generally a far greater complement your for many who has fixed will set you back therefore choose the balance out of an extended-term, repaired monthly payment. Just like the HELOANs offer a-one-day lump sum of cash, such financing are best to own a much bigger, one-go out expensesinstance a holiday or an urgent scientific statement. With a house Security Financing, you’ll also have the advantage of a having to pay cap already in put, and you will probably know exactly how much cash you will have to pay off.

Qualifications to own a house guarantee loan otherwise HELOC around the latest limit number revealed depends on the information considering home collateral application. With regards to the lender, loans more than $250,000 need a call at-domestic assessment and you may term insurance coverage. Depending on the financial, HELOC borrowers must take an initial mark of your greater out-of $fifty,000 otherwise fifty% of overall line number at closure, except for the Colorado, where minimal initially mark in the closing is $sixty,000; then HELOC brings try prohibited in the very first 90 days following the closing; adopting the basic 3 months pursuing the closing, next HELOC pulls should be $1,000, or higher, but for the Texas, in which the minimal next draw matter are $4,000.