Operating activities include generating and spending cash for business activities. Businesses consider receipts from sales of goods, bank account interest, payments made to vendors, and wages paid to employees as operating activities. Like revenue, expenses include costs accrued through primary and secondary business activities. Primary activities include general administrative expenses, research and development, and the cost of goods sold. Gains include money made from one-time, non-business activities, like selling off old equipment or unused buildings.

You will use your senses, emotions, and critical thinking skills to learn new tasks quickly. Michalowicz flips traditional accounting on its head with “Profit First.” He introduces a straightforward system that ensures profitability, making businesses thrive sustainably. Grasp the principles of how accounting can be employed to inform investment decisions, identify undervalued stocks, and navigate the financial markets 2 2 perpetual v. periodic inventory systems financial and managerial accounting with an informed lens. Shihan Sheriff brings a fresh perspective to financial education, aiming to make accounting accessible to everyone. If you aspire to think like Warren Buffett when assessing investments, this guidebook demystifies the accounting practices that underlie his success.

This book is perfect for busy entrepreneurs who need straightforward, easy-to-implement financial strategies. If time is of the essence and you need quick solutions to federal filing requirements for nonprofits your business finance challenges, Inks’ guide is an invaluable resource. The best finance books provide a wealth of information for accounting professionals.

Navigating through financial intricacies, the authors provide tangible strategies to manage, forecast, and analyze small business finances. Bookkeeping is the process calculating arppu for ios and android apps of tracking income and expenses in your business. It lets you know how you’re doing with cash flow and how your business is doing overall. Staying on top of your bookkeeping is important so that you don’t have unexpected realizations about account balances and expenses.

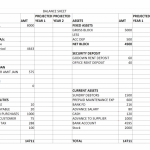

Assets, liabilities, and shareholders’ equity comprise a balance sheet. As you review your accounting strategy, consider your company’s financial goals. Whether you are a solo entrepreneur or employ staff, your business’s success hinges on clearly stated financial objectives. With “Profit First”, Michalowicz offers a fresh perspective on accounting by creating a simplified system that puts profit at the forefront of any business plan. Try The Accounting Game by Darrell Mullis and Judith Orloff, which explains the concepts in straightforward terms using an interesting story format.

Best Accounting Books for Small Business Owners

With a straightforward approach, the book is invaluable for anyone who needs to understand a business’s financial health through its reports. It’s a must-read for those who wish to make informed, intelligent decisions based on a company’s financial status. “Profit First” fundamentally shifts your financial management perspective, guiding you to prioritize profits over revenues. I’ve covered the best accounting books for small business owners, with a range that covers all interest levels; from aspiring CPAs to those allergic to numbers. If this is your first time exploring small business accounting, visit our helpful glossary to become familiar with basic accounting terms. Profit First’s unique approach to financial management proves invaluable for small business owners looking to make sustainable changes in their businesses.

Which Best Accounting Books for Small Business Owners Do You Recommend?

For example, you may have estimated certain invoices that are later solidified with an actual number. Though often confused for each other, there are key differences between bookkeeping and accounting. At its core, bookkeeping is about recording financial data, while accounting is about interpreting financial data. Feel free to share your thoughts on these accounting books and recommend others that might have been missed on my list in the comments below.

- It lets you know how you’re doing with cash flow and how your business is doing overall.

- If this is your first time exploring small business accounting, visit our helpful glossary to become familiar with basic accounting terms.

- Simon Litt is the editor of The CFO Club, specializing in covering a range of financial topics.

- With a structured approach, Label demystifies accounting for those without a financial background, making the subject both comprehensible and engaging.

- Business owners or accountants can then use these statements to gain insight into the business’s financial health.

Bookkeeping Tools and Software

Whether you’re learning to create financial statements, handle taxes, or detect fraud, this book offers valuable insights and practical tips to manage your business’s finances effectively. From understanding balance sheets and income statements to the nuances of managerial accounting practices, this guide covers all the essentials in a digestible format. Mark P. Holtzman’s “Managerial Accounting For Dummies” simplifies complex managerial accounting concepts for students, professionals, and small business owners. The book navigates through fundamental aspects of managerial accounting, providing insightful explanations and practical examples.

ClydeBank Business is a brand known for producing high-quality educational guides for business professionals and enthusiasts. You can connect with ClydeBank Business through their official LinkedIn or visit their official website for more resources and updates. Thomas Ittelson is a seasoned author and expert in presenting intricate financial concepts simply.