This is what the price dysfunction might look instance for a great USDA Minimal recovery loan to possess an excellent $3 hundred,000 house with good $thirty-five,000 reple assumes your tools was switched on within time of the assessment.

USDA Limited example

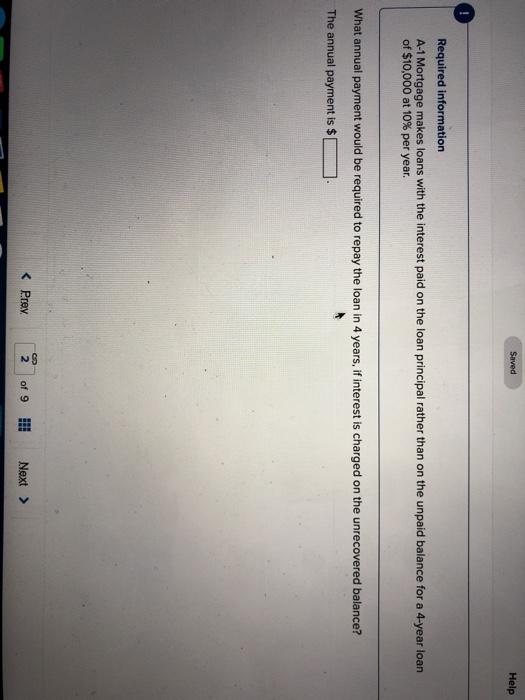

Today why don’t we look at a possible malfunction to own an excellent USDA Simple restoration financing where the debtor was recognized to have $250,000 which can be to find property to have $200,000.

Inside example, we shall guess the new tools aren’t fired up at the time of assessment, and so the contingency amount was 15% of your own repair funds.

USDA Important analogy

A USDA fixer-top mortgage offers the exact same key work with once the a good USDA purchase loan: 100% investment having just one-family home. you obtain the added bonus away from money 100% of your recovery can cost you also. Put simply, you should buy and you may remodel that have an individual financing, every in the little currency off.

Together with, in case your residence’s really worth immediately following home improvements is over what you owe in your financial, you have quick security regarding the assets.

- The house need to be in a great USDA-eligible rural or suburban urban area

- You must meet up with the income limitations towards city where you want purchasing

- Credit history off 620 or higher (in the event loan providers is able to approve you that have a lower life expectancy rating while if not creditworthy)

- A being qualified personal debt-to-money proportion* dependent on USDA’s Protected Automatic Underwriting

Like with a USDA pick mortgage, USDA renovation finance wanted an appraisal, and therefore their bank usually acquisition after you wade around bargain on the a property. Additionally, you will need to find a contractor and you can receive good formal quote, otherwise a price including the range from performs and you may relevant will set you back, and supply you to definitely for the lender.

A quick mention to your USDA income limits: Lenders look at the household earnings minus greeting write-offs to determine their USDA qualifications. No matter if your earnings appears to be higher than the newest limitations for your town, you may still qualify after write-offs was taken.

This is exactly why it certainly is a good idea to communicate with a good USDA lender instead of speculating at the qualification oneself. If you aren’t USDA qualified, your lender will highlight hence almost every other financing software may functions for you.

There are a number of zero and you can low-down fee loan selection, plus lender helps you choose the best you to.

To acquire an excellent fixer-top that have an excellent USDA mortgage: How it operates

Many of the methods involved in purchasing good fixer-higher having an effective USDA repair loan are like those people you’ll proceed through with a USDA buy financing. But there are lots of extras, especially just like the restoration work initiate.

Step 1: Get preapproved

This needs to be your first step long lasting variety of mortgage your desire to rating. Your preapproval letter will say to you how much cash you can use while the style of money you qualify for. As we mentioned above, their restrict preapproval number is when much you could potentially acquire complete, such as the price and recovery will cost you.

2: Create a deal towards property

Make sure your real estate agent knows that you intend so you can have fun with good USDA mortgage to buy your home. Like that they’re able to guide you house that will be when you look at the USDA-eligible elements just.

Step three: Get a hold of a specialist and you can schedule the new assessment

Shortly after your offer try recognized, their bank will start control your loan and you need discover cashadvanceamerica.net emergency loans online a specialist to submit a renovation quote on the lender. You simply can’t perform some home improvements on your own that have a beneficial USDA repair mortgage, thus start looking forever designers towards you just as you choose one fund.