Ideas on how to Finance Mobile Family Parks Significantly less than $five-hundred,000 In expense

To invest in quicker mobile house areas is sometimes very worthwhile. Among the better profit from a limit price position come from parks under $five-hundred,000 as a whole rates. But exactly how would you financing such reduced services, since the majority lenders need deals more throughout the $1 million + diversity? Within this basic Lecture Show Knowledge out of 2018, Honest Rolfe is just about to offer an thorough post on this new different alternatives to invest in sale at this speed height. He will talk about each other in container and you can outside the package steps, and provide genuine-lifestyle samples of each one of these, according to actual selling that he and you may Dave have made more recent years. Due to the fact 5th largest cellular home playground proprietor on the U.S in conjunction together with lover Dave Reynolds you will have more than 2 decades of factors and you may feel discussed contained in this feel.

If you’d like to know event to progress which have mobile home parks of the many shapes and forms, attend all of our Cellular Domestic Park Investor’s Training. You will then see tips select, examine, discuss, perform due diligence toward, funds, turn-doing and you may perform cellular house parks. The course is actually coached from the Honest Rolfe who, along with his partner Dave Reynolds, is among the premier owners of mobile family parks for the new You.S. To learn more, Click here otherwise contact us at (855) 879-2738.

Thank you for visiting tonight’s lecture series skills on the best way to financing mobile family areas to the cost from around $five-hundred,000. This is Honest Rolfe, and this refers to a very, hot matter with lots of, most people searching for its first park otherwise its 31st park just like the you might be types of within the a zero man’s property and if you find yourself around $750,000 in order to a million cash in cost. What’s the huge difference in ways? Well, the difference is much away from financial institutions simply can’t stand creating quicker mobile household playground money. The thing that makes you to? Well, perhaps due to the fact of numerous banks glance at cellular household areas as actually a strange investment classification. Because of this they look and you will state, “Well, I am able to manage an individual house for the amount and for this reason, I will simply stick to the thing i know and you can hence my employers only help us from inside the financing in the home stadium.

Then when you earn big, you then become significantly more glamorous because people can’t stand to make financing into belongings from the you to definitely, a few, three billion money assortment

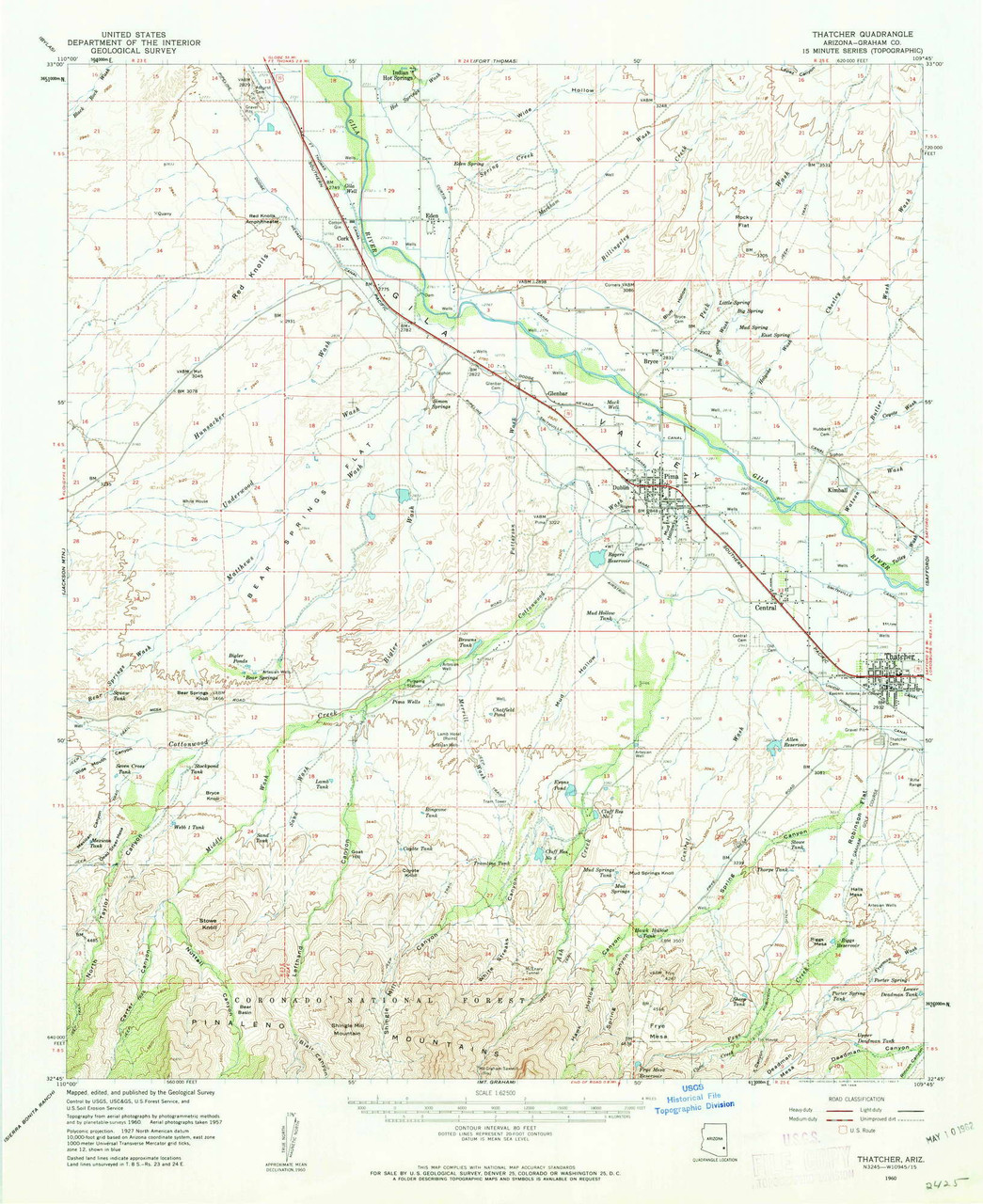

That’s most high-risk, very because arena they would as an alternative manage industrial financing including since the mobile family areas which is the reason why there can be much better supply to things like Service loans and you will Conduit loans where you start entering this new mil together with price range. But that doesn’t mean that there commonly some very nice selling you will discover indeed there in areas that prices $100 loan places Madison Center,000, $200, $3 hundred, $eight hundred, $500. One another Dave and i also started out with areas that were not as much as $500,000. in price. My personal first you to definitely Glenhaven cellular Household Park into the Dallas, the purchase price are $eight hundred,000 thus each of men and women first started inside stadium and extremely all of our very early areas have been always a 500,000 cash otherwise less.

Exactly how do you do it? How will you get loans at this cost? Thus that is what we will talk about this evening, and you may we are going to start off by the talking about merchant financing. Now which is the way i got in the organization, that’s my first park Glenhaven. That is the way i got it financed. This is why I bought it absolutely was due to the fact vendor was ready to bring this new papers inside. If that’s the case, bring the paper fully advertisements therefore i couldn’t, actually want to get a financial loan in it. Thus seller financing is extremely really attractive blogs.