Finally, inside the 2020, Guild Financial repaid a settlement away from $24.9 mil into All of us to own failing to realize FHA financing assistance, consciously granting risky finance and you can gathering FHA mortgage insurance coverage when told you financing defaulted.

While we usually make an effort to are direct or over-to-time information on regulating and you may legal actions, do not claim this article is over otherwise totally doing date. I encourage you do your own search, too.

Guild Mortgage’s Usage of

Guild Home loan works for borrowers who want the ease provided by digital tools (on line pre-certification, digital files and you may faster control) but do not need certainly to compromise head communications through its financing manager.

Availability

Guild Financial enjoys more 200 physical twigs inside the thirty two states and you will deals with regional creditors during the 48 says and Washington, D.C.

The newest lender’s online software program is built to link you to definitely an excellent loan manager, who’ll show which financing also offers appear, offered your debts.

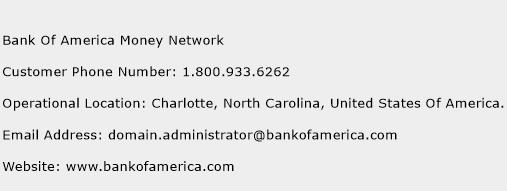

Contact information

- (800) 365-4441 to own people having a preexisting Guild Mortgage for further inquiries.

- (800) 971-3864 for new customers otherwise general concerns

- (800) 365-4884 on lender’s Loan Counseling Agencies

Consumer experience

Users can merely find online explainers and you may courses for each of Guild Mortgage’s financing factors, in addition to financial hand calculators and an internet app.

In the event the applicant decides to move ahead to your application for the loan, the loan officer are working together to submit most of the pre-acceptance documents digitally.

According to financial, borrowers is also submit most closure records digitally and you may shorten the past into the-individual closure to just moments. Immediately following closure, homeowners normally fill out mortgage repayments on the web (an effective $7 surcharge can get incorporate) or owing to ACH cable transmits (automatic otherwise one to-time) off their loans Shelby bank account.

Constraints

Guild Mortgage’s on the web support operates of 8:29 a.yards to 4 p.m PT as there are no email address getting inquiries outside which schedule. Also, brand new speak suits users contacting Guild Financial that have a particular purpose (to purchase, refinancing otherwise servicing a current financing), perhaps not general orientation.

- Guild-to-Go connects real estate professionals that have a Guild Mortgage officer. Pages normally refer members, make pre-approval letters and you can monitor the mortgage techniques from beginning to end.

- My Mortgage Specialist also provides a great pared-off form of the educational content and you may home loan hand calculators available on your website rather than far otherwise. The new application was improperly examined on google Enjoy and Fruit Store because of its restricted capabilities.

Guild Mortgage’s Customer happiness

Our lookup to possess customer satisfaction that have Guild Home loan returned combined overall performance. The business received greatest score for the consumer fulfillment studies, yet the Individual Monetary Safeguards Bureau (CFPB) reported multiple customers complaints.

I together with read customers recommendations in the Bbb (BBB) and TrustPilot, however, clients should become aware of that shot measurements of these types of recommendations is really small (38 on Bbb and simply 1 in TrustPilot).

Customer Grievances

Of 2019 in order to 2022, people filed 142 grievances up against Guild Financial on the CFPB, which have 123 of them 407 objections are linked to financial things, especially FHA-loans. Really says pertain to the new commission techniques issues (missing repayments, unanswered phone calls and difficulties with on the internet accounts and commission programs).

All of the issues submitted inside the 2022 had been signed with a punctual response regarding business, as was basically more states recorded in the past a few years.

Third-Party Feedback

J.D. Power, a firm one assesses customer investigation all over various other areas, posts yearly customer care score considering a-1,000 area size.

Inside the 2021 Guild Financial made greatest results in two studies: this new You.S Pri You.S Pri, Guild Home loan nonetheless obtained above business average but fell to sixth place in the mortgage Servicer Fulfillment Studies (in the past called the You.S Top Financial Servicer Studies).