Possessing your own house may seem such as for example a hopeless fantasy, or if you get own your property and value shedding they – in both cases, you will find software that may help you having homeownership:

Homeownership Apps

- Deposit and you may mortgage apps helps you purchase property.

- Brand new Point 8 homeownership system makes it possible to with mortgage payments into a house when you find yourself already leasing having fun with a section 8 houses alternatives discount.

- Property foreclosure recommendations applications makes it possible to for many who individual your house, but they are concerned about shedding about on the home loan repayments.

A home loan is the style of financing familiar with purchase a beneficial household and other a home. A homebuyer usually has to come up with 20% or higher of your sale price of the home as a beneficial downpayment with the home loan.

You think as you are able to never save up adequate getting a downpayment toward a house, but you can find software that will help with your down commission and you can home loan and that means you won’t need to conserve to you may assist afford the cost of repairs or improvement to make the domestic far more obtainable.

Find out more about their down payment direction apps. CHFA even offers a list of most other advance payment guidance applications into the Colorado.

Homeownership Programs

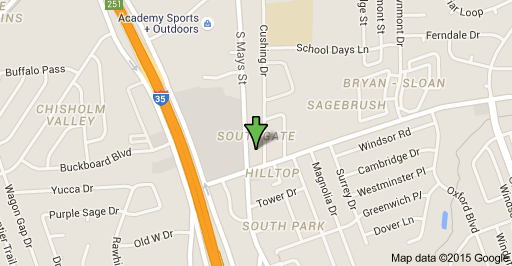

- Some cities and you will counties offer financial help which can reduce your show of your down-payment so you can as little as step one% of one’s purchase price. The guidelines differ for each and every program. The newest You.S. Institution regarding Construction and you can Metropolitan Creativity (HUD) directories homeownership recommendations apps by Texas urban centers and you may towns.

- The brand new Government Houses Management (FHA) also provides mortgages that have down money as low as 3.5%, reduced settlement costs, and easy borrowing from the bank certification.

- Service out-of Experts Things (VA) Lenders appear which have a no down payment.

- Some borrowing from the bank unions or any other loan providers give zero-down-payment mortgage loans.

- Habitat to have Mankind needs only a little down-payment, and after that you setup perspiration payday loan Welaka equity instances helping make your house or the house away from anyone else about homebuilding system; clearing up design websites, doing work in a habitat Restore, or creating Habitat office work and other opportunities plus qualify. Contact your nearest Habitat to possess Humankind section for more information.

- Your loved ones might possibly advice about your downpayment. A cash gift to help with a down-payment are welcome of all form of financing. The brand new provide make a difference to the money taxes of the individual offering the cash, however, you will find always no constraints on amount of brand new provide.

Personal Innovation Accounts (IDAs)

One Advancement Account allows you to cut back currency to shop for a property, purchase advanced schooling, otherwise work with your online business. To open up a keen IDA, you should get a hold of a keen IDA system towards you and meet specific qualification criteria. After you open your bank account, the newest mentor of IDA program will get match the loans you deposit, providing your account build faster.

The newest qualification guidelines to own IDA programs differ. Generally, you should be functioning, but have lowest complete earnings. Once you are in the fresh new IDA system, you ought to together with just take economic training classes one prepare yourself you to own homeownership.

The greatest benefit of a keen IDA is the fact each time you deposit money into your checking account, the latest sponsors of the IDA program match your own deposit with money of their own.

A unique work with would be the fact some federally financed IDA programs permit you to keep upwards money without worrying on the house restrictions for applications including Supplemental Security Income (SSI).