While simple interest only earns interest on the initial balance, compound interest earns interest on both the initial balance and the interest accumulated from previous periods. You should know that simple interest is something different than the compound interest. On the other hand, compound interest is the interest on the initial principal plus the interest which has been accumulated. You can use the compound interest equation to find the value of an investment after a specified period or estimate the rate you have earned when buying and selling some investments. It also allows you to answer some other questions, such as how long it will take to double your investment. Where I is the effective interest rate and the rest of the notation is as above.

Simple vs. compound interest

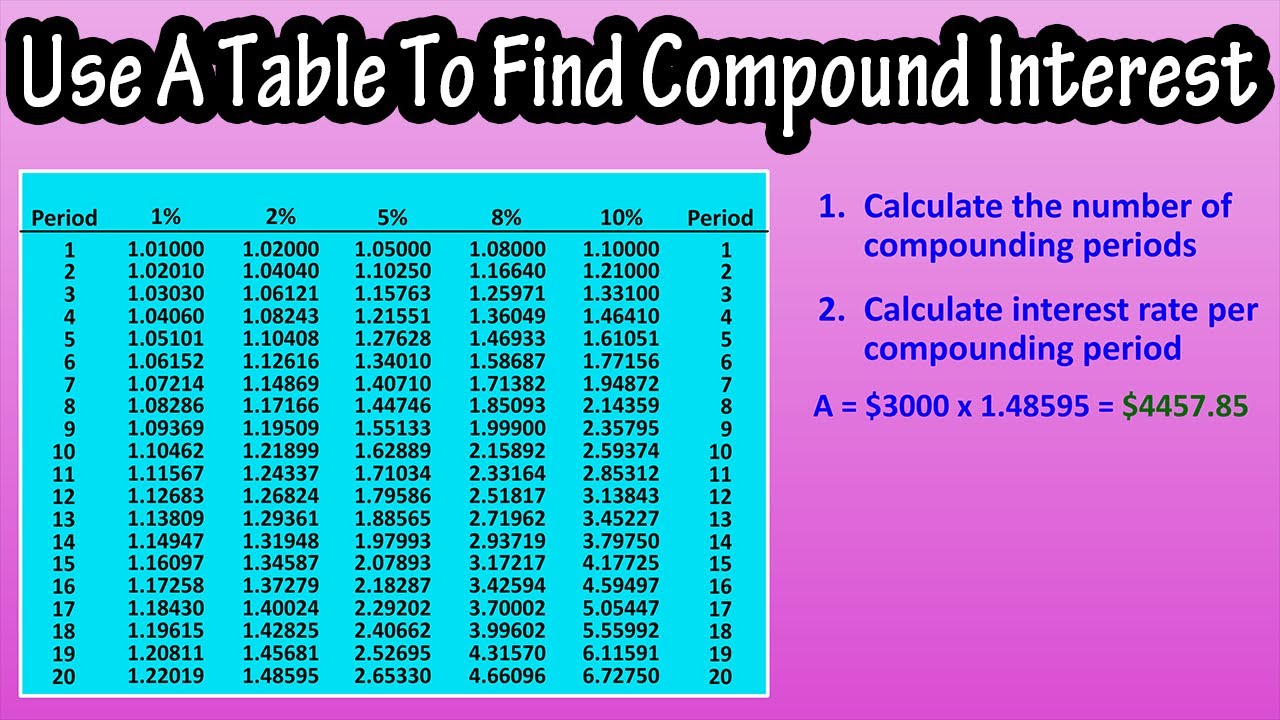

When calculating compound interest, the number of compounding periods makes a significant difference for future earnings. Most financial advisors will tell you that compound frequency is the number of compounding periods in a year. In other words, compounding frequency is the time period after which the interest will be calculated on fixed asset turnover ratio formula example calculation explanation top of the initial amount. This compound interest calculator is a tool to help you estimate how much money you will earn on your deposit. In order to make smart financial decisions, you need to be able to foresee the final result. The most common real-life application of the compound interest formula is a regular savings calculation.

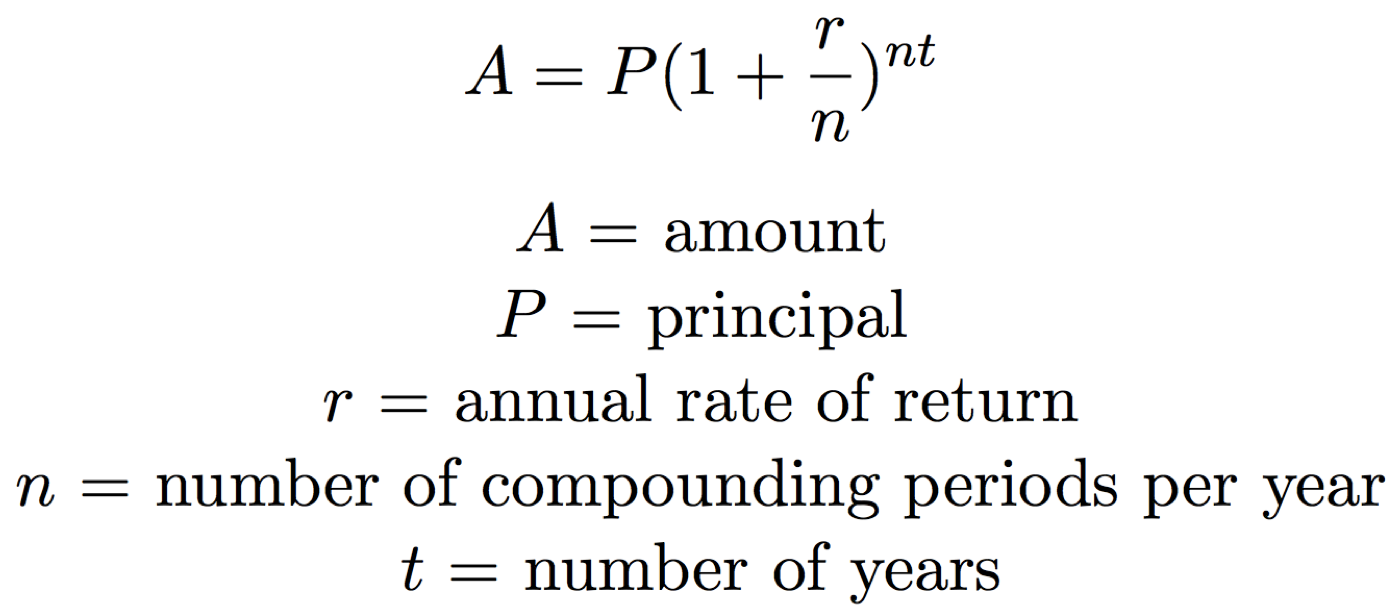

Calculate Accrued Amount (Future Value FV) using A = P(1 + r/n)^nt

The rate of return on many investments is speculative, so entering an average number can give you an idea of how much you’ll earn over time. The rate of return you earn on your investments can make a big difference. See what the change in your balance is if you increase or decrease your rate of return by 1 or 2 percentage points. More frequent compounding periods means greater compounding interest, but the frequency has diminishing returns. This example shows the interest accrued on a $10,000 investment that compounds annually at 7% for four different compounding periods over 10 years. You should always consult a qualified professional when making important financial decisions and long-term agreements, such as long-term bank deposits.

Example calculation

For example, Roman law condemned compound interest, and both Christian and Islamic texts described it as a sin. Nevertheless, lenders have used compound interest since medieval times, and it gained wider use with the creation of compound interest tables in the 1600s. Let’s cover some frequently asked questions about our compound interest calculator. You can also calculate compound interest using our interest calculator, which allows you to calculate either simple or compound interest.

- The Rule of 72 provides an approximation of the time to double by dividing 72 by the annual interest rate.

- This formula is useful if you want to work backwards and calculate how much your starting balance would need to be in order to achieve a future monetary value.

- The frequency that interest is compounded can have a large effect on the growth over time.

- If you wonder how to calculate compound interest, these formulas provide the answer.

- The simple interest account earns a total of [latex]\$500[/latex] in interest.

Yes, email me a screenshot of my calculator results!

Jacob Bernoulli discovered e while studying compound interest in 1683. He understood that having more compounding periods within a specified finite period led to faster growth of the principal. It did not matter whether one measured the intervals in years, months, or any other unit of measurement. Bernoulli also discerned that this sequence eventually approached a limit, e, which describes the relationship between the plateau and the interest rate when compounding. The simple interest account earns a total of [latex]\$500[/latex] in interest.

Or,you may be considering retirement and wondering how long your money might last with regular withdrawals. In our first example, the total principal was $10,000 since there were no contributions. However, the total principal in the second example was $11,500 because $1,500 in contributions were added to the beginning principal of $10,000. As you can see, it is much easier to use a compound interest calculator.

But the compound interest account earns [latex]\$610.51[/latex] in interest (the sum of the accrued interest column), which is [latex]\$110.51[/latex] more interest than the simple interest account. As an investor, you earn more interest on an investment when the interest is compounded than you would with simple interest. But this also means that as a borrower, you will pay more interest on a loan when the interest is compounded than with simple interest. Estimate your savings or spending through our compound interest calculator.

Laura started her career in Finance a decade ago and provides strategic financial management consulting. The longer you take to pay off your debts, the higher your compounding interest will be, and you’ll end up paying back much more in the end. You could get rid of them now, but instead, you wait a few days to take care of them.