The home It is possible to Program even offers a lowered down payment than FHA money. 5%) and supply a number of options getting event downpayment financing without digging into your own pocket.

Possibly Lower Interest levels

The interest rates towards the Domestic You’ll money take par having the standard 97 loan, which happen to be generally below interest levels given getting FHA fund. Interest rates are very different according to research by the lender, mortgage to worthy of (LTV) proportion, borrowers’ credit scores and other items. However, while you qualify, you could potentially be eligible for a lesser interest having Home You are able to than together with other financial software.

Non-Occupant Co-Borrowers

Freddie Mac do give an exclusion to own low-tenant co-individuals, definition never assume all borrowers must live in our home. A minumum of one borrower need certainly to take the home shortly after closing, very Household You’ll be able to wouldn’t work for resource properties, nevertheless non-renter allowance might help individuals which have lower borrowing so you can be considered having a great co-signer.

Lower Month-to-month PMI Costs

You spend less with the Individual Financial Insurance policies (PMI) costs, particularly if you have more substantial advance payment. FHA funds require 0.85% of your amount borrowed per year for most borrowers, but Domestic You can easily borrowers you will qualify for PMI as little as 0.5%, depending on fico scores together with LTV proportion. Even better, PMI is easy to remove from property Possible loan entirely just after the newest LTV ratio drops less than 80% (meaning at the least 20% of the house value has been paid).

No Up-Front Financial Insurance rates Costs

And additionally monthly PMI will cost you, FHA loans need an up-front side financial insurance rates percentage of 1.75% of one’s loan. Having Domestic Possible, there are not any up-front side mortgage insurance fees.

Downsides of the property Possible Program

Just like any financial system, you can find constantly a number of downsides. It’s important just like the a debtor to understand him or her.

Income Restrictions

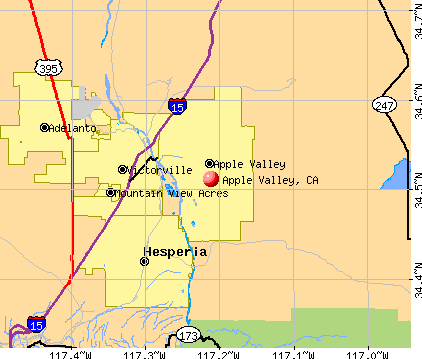

The cash of all of the borrowers with the loan should not surpass 80% of average money to your city where the house is receive. Consumers in a few elements that 2400 dollar loans in Elkmont AL have lower median income profile might have trouble meeting which certification specifications.

Financing Limitations

While there is zero given restriction financing restriction getting Home You can easily, the newest certification to have doing the application reduce sized the borrowed funds. While the consumers can simply secure 80% of average income due to their urban area additionally the maximum debt-to-earnings proportion (including the Domestic It is possible to home loan) try 43%, your own restrict mortgage maximum within the system was influenced by their local area, your current income and your current debt.

Higher Credit history Requirements

House Possible need the very least credit score from 660 for all borrowers. These score standards are greater than other companies such as for instance FHA (that have a minimum get off 580) otherwise Fannie Mae’s HomeReady system (which have the very least rating away from 620).

Residency Conditions

Even in the event low-renter consumers are allowed towards mortgage for example-tool qualities, one or more of your own consumers need certainly to reside in the house full-date once closure. That it requisite setting House It is possible to can’t be utilized for vacation belongings or money functions in which the borrower does not live on-web site.

Domestic You can easily versus HomeReady System

First-go out homebuyers or lowest-earnings borrowers could be examining numerous home loan options to reach homeownership. And Freddie Mac’s Home You are able to System, a similar choice is available using Fannie Mae’s HomeReady Program.

Both applications was similar for the reason that both of them address earliest-time and low-earnings consumers and offer similar advantages in the way of lower down costs, cancellable PMI, and you may equivalent certification conditions. The biggest change ‘s the credit rating criteria. The home You are able to financial support means a minimum of 660, if you are HomeReady borrowers normally qualify that have scores as little as 620.