One of the primary questions people enjoys when they think about a roof enterprise is within mention of how-to purchase another type of roof. There are situations where your panels cannot be arranged ahead of time, and thus the newest citizen does not have any time for you to conserve having the latest roof, nonetheless they anxiously you want another one include their home. Whenever you are curious simple tips to pay for a ceiling without currency, we’ve got responses here.

Substitution a roof is just one of the more expensive do-it-yourself tactics a homeowner takes on, however it is an essential one due to the fact rooftop protects the home and you may all things in they, out of lifestyle to possessions. If you want another rooftop but can not afford to invest for it upfront, you can buy what you want now and pay it off over the years with capital. In an excellent community, money would never be needed, in some examples money is the perfect provider.

How exactly to pay for your roof substitute for

Whether you’re planning for a special rooftop down the road otherwise all of a sudden realize you need one to today, you should know how exactly to purchase roof replacement for information and you can labor. Prices is among the greatest inquiries of every home improvement business and you can roof isn’t any various other, due to the fact cost of a unique roof range between $8,five-hundred and you may $20,000.

If you find yourself like most people, there is no need thousands of dollars resting doing waiting to getting invested. Maybe you’ve got a tiny advance payment readily available or perhaps your have no cash to invest right now. Throughout these activities, roof replacement financial support will get your sole option.

First, you should select a threshold replacement for business that gives financial support, but that’s only part of the problem solving need to consider, as you in addition need the fresh contractor to be a https://simplycashadvance.net/loans/single-payment-loans/ verified specialist on the things they’re doing, capable of handling your roof replacement for as opposed to situation. Luckily for us, very credible roof builders promote resource choice which can suit your requires.

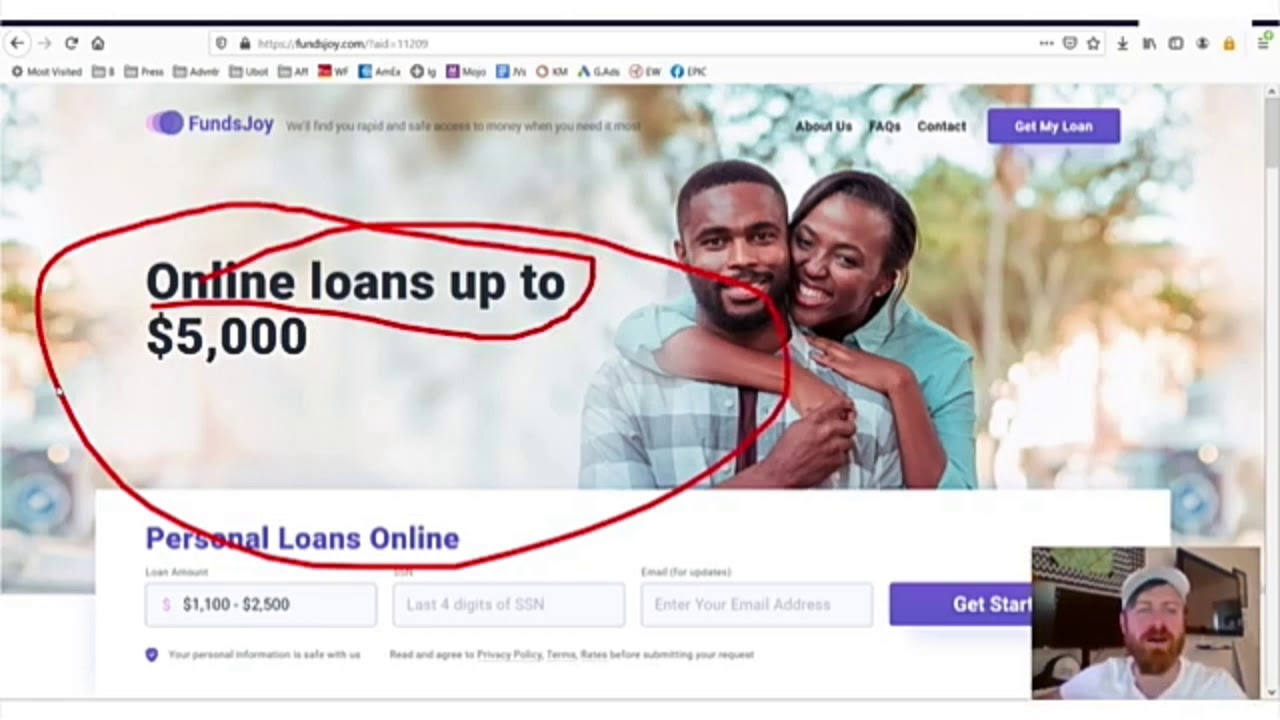

Other choices having buying a different rooftop is a property collateral loan, a property equity line of credit, a property update financing from your own bank or if perhaps everything else goes wrong, a charge card to fund brand new rooftop. The original choices are basically lowest payment capital money, however, bank card payments shall be sky-high, some having an annual percentage rate away from 31% or even more, so that will be the solution if all else goes wrong.

Rooftop funding said

Your credit score/records might possibly be a big determiner off just what roof construction money solutions would-be available. The latest terms and conditions you get could well be some not the same as what a beneficial family member, buddy, neighbors otherwise work associate only based on the variations in your own credit score. As well as, financial support selection usually disagree for each and every financing muscles, which means your better roof capital solution may not be discover if you don’t do a lot of browse.

What exactly is roof financing?

Rooftop money are a handy financing option targeted at residents and you may companies trying cover the expenses from a special roof. Permits you to definitely pass on the cost through the years, reducing financial filter systems. These types of choice differ, which have interest levels and you can conditions influenced by loan providers. Having roof money, you could potentially punctually target roofing activities, guaranteeing the protection and you may safeguards in your home about factors.

Roof money terminology you should know

When you find yourself fresh to roof money, there’s some code/terms and conditions you need to become familiar with. Listed below are some of the maxims to help get you been.

Annual percentage rate stands for apr. Apr may differ from a single debtor to another, also from just one financier to the next. Apr is essentially precisely what the lender fees you towards the loan. When comparing that investment choice to a separate, perhaps one of the most important components is actually Apr.