Tracking the CIBIL rating is a straightforward yet strengthening practice which enables you to control your financial wellness. Daily overseeing their score equips you to detect and rectify any discrepancies, making sure the borrowing character stays inside the a beneficial condition.

step one. See an established Borrowing Bureau’s Site: Pick a reliable credit bureau’s website. Respected credit bureaus inside India were CIBIL, Equifax and Experian.

dos. Navigate to the Credit score See Section: Just after to the picked borrowing bureau’s web site, to track down brand new point seriously interested in checking your credit rating. It could be labelled given that Look at your Score’ or something similar.

Ideas on how to Evaluate CIBIL Rating On the web

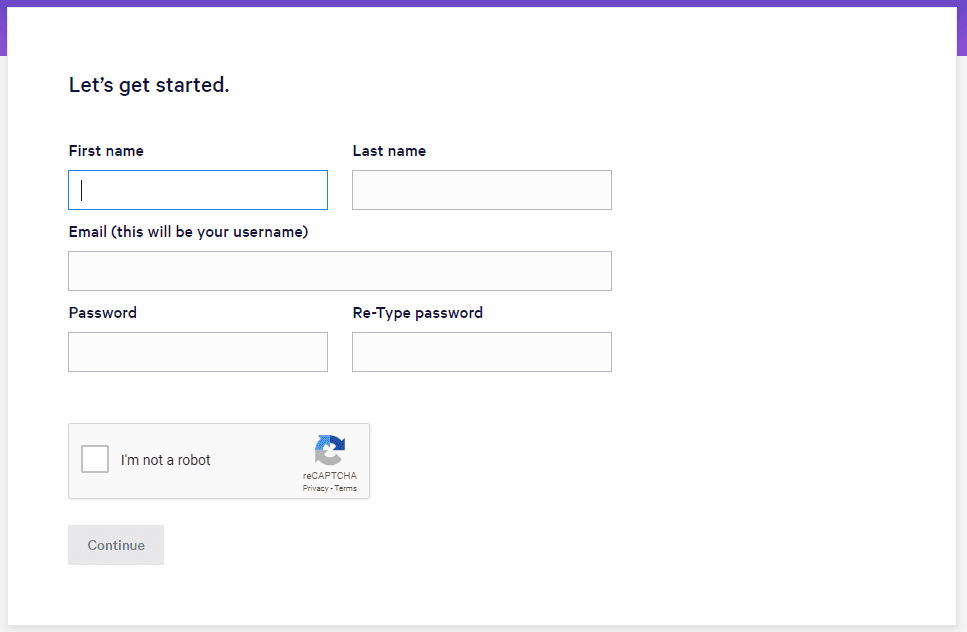

3. Deliver the Called for Information that is personal to have Verification: To access your credit rating, you ought to promote private information to own confirmation. This normally boasts information just like your name, time out-of birth, Long lasting Membership Number (PAN) and contact information.

4. Discovered Your credit rating and you can Credit file Instantly: Once properly verifying your term, you’ll discovered your credit rating and you can credit report instantly. The credit statement will bring an extensive report about your credit score, as well as information on the borrowing from the bank profile, fees records and you may any outstanding money or expenses.

By using this type of strategies faithfully, you can access your CIBIL get and you can credit report instantaneously, empowering one build advised economic behavior.

Should your CIBIL score falls short of the desired threshold, you’ll find active actions you could apply adjust the creditworthiness throughout the years. The following is a more intricate exploration of them procedures:

1. Fast Statement Repayments: Make certain you pay-all their expense on time, at all costs. This consists of credit cards, mortgage EMIs, electric bills and other monetary responsibilities. Late or skipped payments could harm your credit score.

dos. Remove Outstanding Financial obligation: Work diligently to minimize your an excellent loans, such as revolving borrowing from the bank such charge card balance. Aim to maintain a credit utilisation proportion (the brand new part of your borrowing limit put) out-of less than 29%. Large charge card stability in accordance with your own credit limit can be negatively apply to your own rating.

step three. Monitor Borrowing Utilisation: Your own borrowing utilisation ratio is crucial. Take care of an excellent ratio only using a fraction of the offered credit limit. Stop maxing aside credit cards since this can signal monetary stress to creditors.

cuatro. Broaden The Credit: A variety of borrowing from the bank brands can certainly feeling your credit score. Next to handmade cards, think diversifying with other borrowing designs, eg personal loans otherwise shopping levels. Make sure you would such levels responsibly.

5. Avoid Several Loan applications: Each loan application results in an excellent tough inquiry’ in your credit report, which can briefly lower your get. Reduce level of loan applications you make and lookup monetary establishments before you apply. Making an application for numerous money on the other hand can boost concerns about your financial balances.

Because of the implementing these types of outlined actions, you might functions methodically into the improving your CIBIL score over time. That it, therefore, advances their qualifications and you can conditions whenever obtaining a mortgage or any other types of borrowing.

End

Protecting a mortgage try a good monumental step with the homeownership. Now that you understand Necessary CIBIL Score having a home Mortgage, be cautious one an excellent CIBIL rating opens up doorways compared to that possibility if you’re helping you save profit the long term. On a regular basis keeping track of the score, boosting it if payday loans online Austin AR required and you will keeping in charge financial conduct are fundamental so you’re able to gaining your own homeownership requires.

Trust the bank you choose, such as for instance ICICI Lender, to help with their visit your ideal household. That have ICICI Lender Mortgage alternatives, homeownership becomes a real fact. Your dream house awaits and you may ICICI Bank will be here and come up with they an actuality.