If you would like buy a home, you ought to fulfill first conditions to own credit score, income, and a position background as well rescuing to own an advance payment. Accurate guidance vary with respect to the variety of home loan you employ.

Thank goodness, criteria buying property be more lenient than just of numerous basic-date homebuyers assume. Lenders is frequently versatile in terms of things such as borrowing from the bank and you will advance payment. Here is what you’ll want to meet the requirements.

You might still meet the requirements which have two later money during the for the last 1 year, but as long as the financial institution allows your reasons having lateness

If you do not can pay dollars, you need an interest rate to finance your brand new family buy. The borrowed funds process may seem challenging to start with, but appointment your loan’s requirements must not be too much.

- Suitable credit score: Your own FICO score should meet lowest credit history standards, which range from 580 to 620 according to loan method of

- A steady earnings: Your income over the past a couple of years can tell you can also be manage monthly mortgage repayments

- Enough discounts: You will need enough currency to the minimal down payment and you can spend closing costs, although it’s possible to get some good assistance with that it

- A modest obligations-to-money proportion (DTI): Lenders tend to look at the current expense to make sure you you are going to afford to add your new mortgage payment matter every month

- Documentation: You’ll want to document your earnings, debts, and you may coupons from the revealing the right monetary data files along with your mortgage officer

- Good preapproval: A home loan preapproval places all these pieces to each other to determine whether a loan is the better financial for you

Some of these standards will vary according to the brand of mortgage you decide on. Very why don’t we look directly at each and every criteria.

The truth is, you don’t have higher level borrowing to get a mortgage. More homebuyer apps have different borrowing from the bank conditions, and often you can meet the requirements with a credit rating since reduced given that 580. Keep in mind that less credit score often means purchasing increased home loan speed.

- Old-fashioned financial: Lowest credit rating off 620

- FHA financial: Lowest credit score away from 580, although some lenders you are going to create a score as low as five-hundred which have ten% off

- USDA financial: Minimal credit score away from 640

- Virtual assistant mortgage: Extremely lenders require 580-620

Getting clear, just because you can be eligible for home financing that have the lowest score, doesn’t necessarily mean you are going to. Loan providers get over your own rating into account. Might along with feedback your credit reports, using close attention towards newest credit history.

While in search of bumping enhance credit rating, their lender possess the capability to assist, recommends Jon Meyer, The mortgage Accounts financing specialist and you can signed up MLO.

In the event lenders will at the credit history and borrowing get, one may get a mortgage with no credit score.

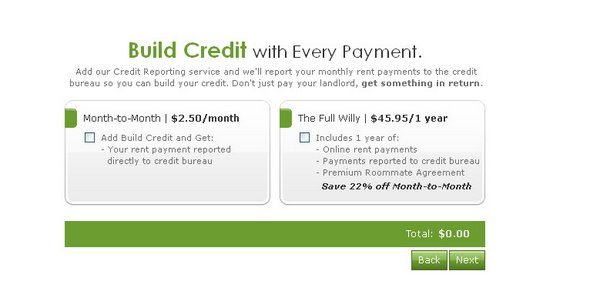

Some loan applications, such as for example FHA, Virtual assistant, and you may USDA, let the use of non-conventional borrowing from the bank on the a home loan software. You could introduce great site creditworthiness because of things like power costs, rent repayments, insurance coverage repayments, and you will mobile phone repayments. Even if, mortgage cost tend to be rather large for these particular unique factors.

Even specific old-fashioned lenders you’ll accept a great several-month reputation of book and you can electricity costs in place of a beneficial credit rating, whether or not this is very uncommon.

Imagine if I’ve less than perfect credit or a bankruptcy?

So you can be eligible for a mortgage loan – despite a decreased credit history – you generally cannot have any defaulted financing or later money for the your credit history within the past one year. That isn’t a challenging-and-timely signal, though.