There are certain what you want to do prior to your intimate for the a property. Things such as trying to get that loan, scheduling a property review, and purchasing homeowner’s insurance coverage, just to label a number of. To make the procedure easier to understand, is a summary of nine things you’ll need to perform before closure on your own brand new home.

step 1. Apply for that loan

For folks who currently have pre-approval, this is the time to try to get a mortgage loan. For folks who didn’t obtain pre-acceptance, you will need to examine cost off mortgage lenders to obtain the better mortgage.

Jen LaCroix, our very own Community Financing Manager toward Habitat Homeownership System, has some tips about how to prepare your loan administrator whenever you have paid to the a house:

“The largest holdup so you can closure are all of our readers not getting you something as quickly as we need all of them, or perhaps not understanding what they’re asked for. If you features inquiries, make sure to have discover communication with your mortgage administrator.”

2. loans Pell City Ready yourself to pay Closing Costs

A home loan isn’t the just percentage you’ll have to create in order to buy your family. Additionally need to pay settlement costs. Normally anywhere between dos% in order to 5% of your cost of our home. You should also be prepared to pay almost every other fees which come that have closing, such as an excellent Homeowner’s Association commission.

step three. Take a look at the brand new Label

The last thing we would like to hear when you purchase good residence is that supplier cannot actually contain it. This might voice strange, although it does occurs. This is why it’s important to feel the term to your house checked out. Hire a title checker with the intention that no body else can be allege he’s possession of your property.

cuatro. Score a house Assessment

Before you close the deal, the bank often hire an unbiased top-notch to select the worthy of of the house. In the event your house appraises for around what you are spending because of it, the lending company will be more confident in lending you the money because they know the guarantee is the same otherwise higher worth compared to the loan. In contrast, this will along with protect people away from overpaying.

5. Plan property Examination

Extremely loan providers will require an examination, however you will want one to anyhow to test in the event the you can find people issues with the house before you move in. Whether your inspector discovers any structural problems or dilemmas on the residence’s amenities, you might be capable negotiate to obtain the provider develop them. This is particularly true if they didn’t inform you of the issue before you could made an offer.

6. Rating Homeowner’s Insurance coverage

Before you could personal on your family, you’re required to show evidence of homeowner’s insurance rates. This really is insurance that assists purchase damage to your residence. Homeowner’s insurance rates always talks about interior destroy, exterior destroy, loss of individual belongings, and you will injury that happens towards possessions.

eight. Import Tools

Getting into a new house is exciting! However, getting into a different sort of home and you will discovering that the liquid can not work is a lot reduced fun. Before you could move in, call the fresh power enterprises close by in order to transfer the newest fuel, liquid, and energy into your term.

8. Just take a final Stroll-Thanks to

Regarding the days before you could close in your home, you’re allowed a final stroll-due to. It’s your history possibility to make sure that there aren’t any affairs or damage hence the home includes everything you assured for the their contract.

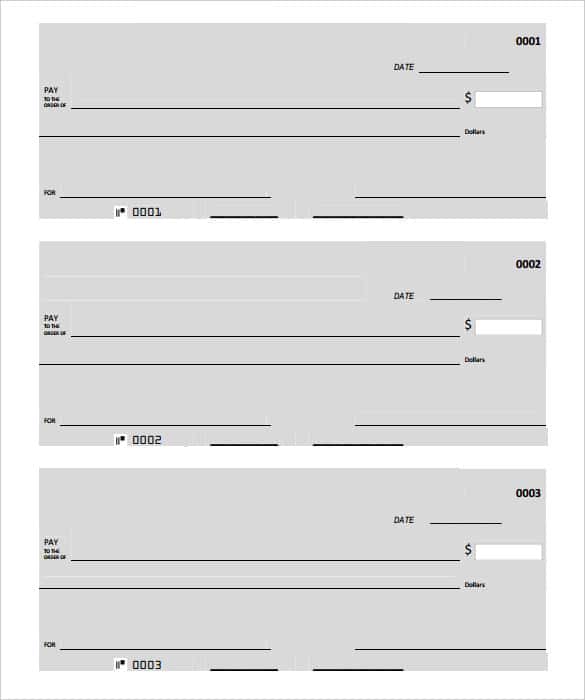

9. Signal Financial Data files

Now, it’s the perfect time into the wedding day! When you go to sign the mortgage records, just be sure to provide an excellent cashier’s evaluate to pay closure can cost you, including a photo ID. When you signal the fresh new records, it’s time to celebrate! You are today technically a resident.