- So what does a lender see into the a standard mortgage software?

This article has been appeared by one Contrast Club pro. Which see gives you rely on you to everything discover here is the very best quality content backed by all of our ExpertEase.

Once upon a time, inside a financing surroundings well away, We spent some time working since the a mortgage broker. All once in a while, I’m reminded that financial candidates don’t know exactly what a beneficial lender actively seeks once they assess your property loan application. Therefore, I have busted they off here.

Once you make an application for home financing, you might be generally inquiring a lender so you’re able to front side the currency to purchase a home otherwise apartment and you are asking these to invest in so it getting twenty-five-three decades.

Very mortgage brokers commonly kept for the long, your financial must imagine might wait, plus they could need to confirm which so you can regulating authorities, for instance the Australian Prudential and you may Regulatory Power (APRA).

Below Australia’s in charge financing debt, it think all software meticulously. The fresh new Australian Ties and you will Resource Payment (ASIC) also has rules as much as in charge lending.

Brand new Five Cs from Borrowing from the bank

Capacity: might you pay off your property financing? Have you got a reliable business and you can constant money? Do you have most other costs?

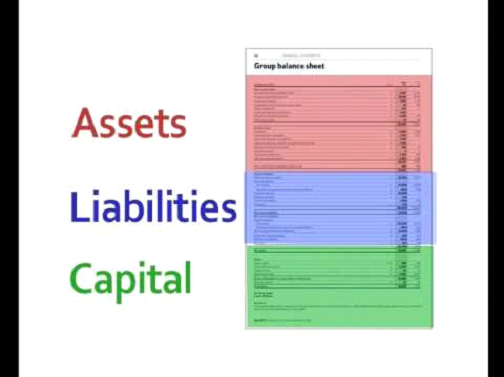

This last part takes into account the value of everything you own, and the value of everything you owe. The difference between these two numbers is your online really worth .

Income

Incentives, overtime, and other more pay perform amount but they are assessed in another way by the each lender. loan places Fairfield Usually, your loan evaluation often foot this type of wide variety with the mediocre out of that it income more than couple of years.

When the earnings form a major section of your revenue, be sure to focus on a broker whom knows which. Some loan providers don’t allow profits to help you matter given that earnings, specific simply total so you’re able to 80% of complete income, although some will need every thing. A beneficial broker can ascertain where you can bring your mortgage for the best risk of achievements.

Side-hustles are not tend to treated just like the normal money, if you don’t can prove uniform income more than a set several months plus next, only a few loan providers encourage which because the income that counts toward your own credit capacity.

Local rental earnings is oftentimes removed at 80% of one’s actual earnings however it depends on your own bank. Short-title accommodations particularly AirBnB may only become calculated from the 50%, and lots of loan providers wouldn’t deal with this earnings after all.

Though some regions was handled in different ways of anybody else, overseas money is oftentimes discount otherwise neglected. Consult with your broker for more information.

Take notice: Self-employed anybody deal with so much more analysis out of loan providers and will have to show he has got a steady income found by the a couple successive decades off organization tax returns. It could be simpler to show your revenue if for example the organization pays your a flat, secure salary.

Employment Record

Uniform employment records is essential particularly if you have been in identical, otherwise similar, jobs for quite some time.

Front side hustles (as mentioned significantly more than) are not normally thought secure income and several lenders keeps tight rules in terms of next services. However, it is far from impossible to understand this income integrated. Speak to an experienced broker who will know the ins and outs.

Savings

A history of preserving your earnings shows you is would currency; ie you’ve got more funds to arrive than just venturing out.

Take note: When your lender discusses your offers, they appear at the normal dumps entering your account in order to build up your balance. A sudden lump sum deposit (for example from your taxation reimburse, inheritance, or a monetary gift), isnt usually considered as offers,’ just like the there isn’t any evidence you situated that it up yourself.