Originator out of SoCal Virtual assistant Land

Whether you’re trying follow a special field path or simply get a unique expertise, the brand new GI Statement are a very important equipment for Veterans of all of the backgrounds. Just like the 1944, the new GI Bill possess assisted millions of Pros pursue exchange university and better training while fueling American monetary prosperity towards long identity. The latest up-to-date Blog post nine/11 GI Expenses, rolling out in 2009, stretched the huge benefits to incorporate a month-to-month construction allotment.

Now, the latest Permanently GI Costs added way more advantages to Veterans. Those discharged otherwise create out of productive responsibility toward otherwise shortly after , won’t end up being at the mercy of the 15-season day limit to your accessibility the GI Expenses advantages. This allows Pros to save discovering and you can increasing their feel during the its whole life. On top of that, brand new Forever GI Expenses provides more benefits to men and women trying research Technology, Technology, Technologies, or Math (Stem subjects).

With all of the experts that the GI Statement provides, of several Pros want to know does the new GI Expenses count due to the fact earnings for an excellent Va mortgage? The solution to it matter utilizes several circumstances, like the armed forces borrower’s financial situation and lender’s direction. Since the audience is a group of really knowledgeable army Seasoned Virtual assistant loan masters and you may Virtual assistant Savvy real estate agents which favor in order to serve Veterans, how you can find out whether these loans can be included in your position will be to communicate with contact us from the (949) 268-7742

What are Lenders Trying to find?

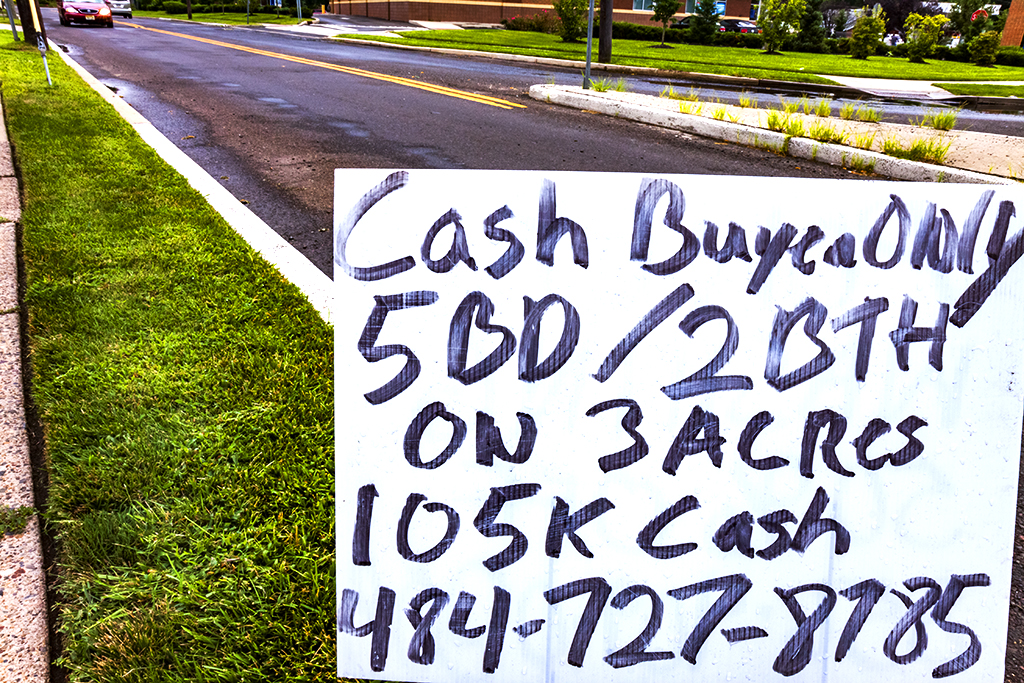

To purchase a property ‘s the single vital purchase that most individuals create. It’s difficult to assume lifestyle the new American Dream devoid of an excellent home of one’s. Due to the fact very few folks have enough money for pick a property along with bucks, mortgage brokers allow us to match our very own construction requirements towards the our lifetime and you may finances.

Lenders make it more folks to attain its requires away from homeownership, yet not without risk. In the event the a debtor ends up and also make costs and non-payments on their loan, foreclosure transformation can cause a loss in money with the financial. No financial would like to look for its individuals foreclosed with the, that’s the reason it lay security toward application techniques and you may thoroughly veterinarian a beneficial borrower’s financial predicament.

Virtual assistant home loans is popular with Veterans for many grounds, for instance the zero off repayments, competitive pricing, and much more easy underwriting direction in the place of that from traditional money. These types of points bring Pros a greater feeling of autonomy in the event it concerns being qualified getting a home loan. Nevertheless, Virtual assistant loan lenders have to have count on that an armed forces borrower tends to make costs punctually. For this reason, they would like to get a hold of a stable, long-label earnings.

Knowledge earnings on GI Expenses merely lasts while you’re within the college, so these types of financing was brief-term naturally. Lenders may take so it money under consideration inside your total financial situation, however, pair, or no commonly amount they to the your energetic, long-term income used to qualify for a loan. This means that it likely cannot seriously apply at the debt-to-money proportion. As well, other styles from military allocation, including the BAH , are mentioned while the a reliable earnings, if you are effective.

If you are your GI Bill financing might not make it easier to be eligible for a Virtual assistant loan individually, the education you obtain can result in a much better-expenses work, that may somewhat increase your house to order electricity. When you put their landscapes toward long-title achievement, this new GI Statement additionally the Virtual assistant Home loan Program are essential gadgets to truly get you for which you want to be. The best way to discover where you’re would be to talk to a lender you can trust .

Is the GI Expenses Evaluation Product

Can you use GI costs money to own a mortgage? Usually, the clear answer is a bit unsatisfactory, but don’t give up hope! (We have consulted that have subscribers for just like the journal just like the 5 years, because they ready to requests property!

You s are around for you. Subsequent education typically setting increased investing job and that means the ability to be eligible for a bigger Virtual assistant mortgage.

The new GI Statement Research Equipment can help you discover colleges, training apps, as well as apprenticeships and must be your earliest stop by your own excursion toward graduation. Simply connect on the army reputation, provider background and some information regarding your own wanted business with the it GI Statement calculator and you will discover a summary of qualified applications in your area. Then you can below are a few guidance eg just how many GI Statement people are presently during the college or university and you may exactly what your prospective allocation is for university fees, homes, and you will offers.

After you’ve discovered an eligible university that suits their academic requirements, get in touch with this new school’s application service otherwise military office for lots more guidance thereby applying!

Obtain the Dialogue Started

Most of the financial predicament is different, specially when you’ve got numerous sourced elements of income. Near the top of a career, you have got BAH, basic spend, self-a career money, Va impairment earnings or GI Expenses funds on blend. The way to learn where exactly your remain http://elitecashadvance.com/loans/student-loans/ when it comes to Virtual assistant home loan recognition is to contact your financial. SoCal Virtual assistant Property can be your basic selection for Pros to find the most useful home because the we have been 100% dedicated to permitting productive responsibility and retired solution players result in the a majority of their army advantages. Call 949-268-7742 now and you can let us help you on your trip!