While you are trying to get home financing to buy property, having a lot of personal debt causes it to be difficult to get approved into the financing. Whenever reviewing your finances to decide whether you can afford the latest the new mortgage repayment, you must in addition to cause of your current personal debt costs.

This means that, you should determine the debt-to-money proportion, otherwise DTI, and this signifies the fresh portion of your own month-to-month money you to goes toward and make debt payments, such as for example financing and you will handmade cards. The debt-to-money proportion is an important metric when trying to help you align funding buying a property, as it’s always influence financial value.

Once funding has been gotten, couples property owners give the obligations-to-money ratio far further believe however, perhaps they have to, since a switch to earnings otherwise addition of brand new loans normally apply to a person’s capability to services current debt. Our mortgage calculator is a useful tool to greatly help imagine month-to-month money. In this article, we shall assist you how DTI proportion is utilized.

Secret Takeaways

- Having excess debt causes it to be challenging to get approved to own an interest rate.

- The debt-to-earnings ratio (DTI) compares the level of overall expenses and debt you must your overall earnings.

- Loan providers look at DTI whenever choosing whether or not to expand borrowing to help you a possible debtor and at just what cost.

- Good DTI is recognized as being less than thirty six%, and you may something significantly more than 43% could possibly get prevent you from taking financing.

Calculating Loans-to-Money Proportion

Figuring your debt-to-income ratio is not difficult. Complete all your valuable monthly personal debt repayments and you will split that matter by your month-to-month revenues, that is your revenue in advance of taxation was basically deducted.

To own an exact measurement, it is vital to are all the amounts of investment property every month repair debt, in addition to every continual personal debt, particularly mortgage loans, car and truck loans, child service costs, and you may mastercard repayments.

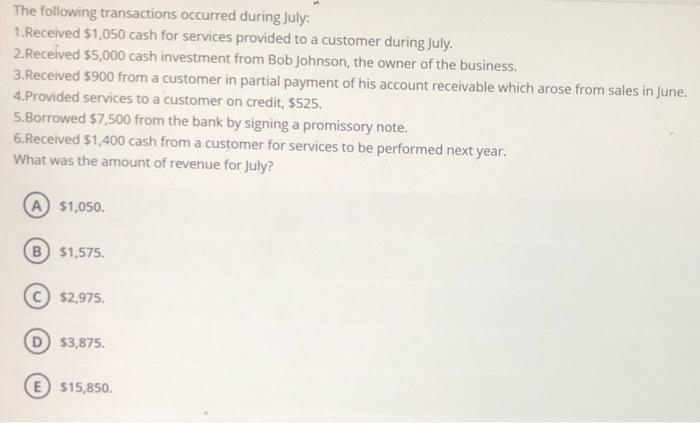

Example of a financial obligation-to-Income Ratio

- Gross income: $4,000

- Car finance: $400

- Handmade cards: $250

- Student loan: $400

- Split total obligations of the gross income: $step 1,050 / $cuatro,000

- Debt-to-earnings proportion = .twenty-six or 26%.

Casing Bills Proportion

An alternate ratio to adopt is the houses-expense proportion, which measures up your own revenues to any or all of one’s construction expenses, that has their homeloan payment, home insurance, taxes, and every other construction-relevant expenses. In order to assess the brand new housing-debts proportion, total your own construction expenses and you can divide they by the gross month-to-month https://cashadvanceamerica.net/loans/direct-express-emergency-cash/ earnings.

Such as for instance, what if you earn $cuatro,000 four weeks and also a home loan expenses off $eight hundred, taxation off $2 hundred, and you will insurance rates expenses off $150. Your full casing expenses could be $750 and divided from the $cuatro,000 carry out produce a casing-debts ratio out-of 19%.

Usually, lenders want to see a construction expenses ratio out-of shorter 28%. A home loan calculator would be a good investment to plan for the new monthly cost of your payment.

You should never mistake the debt-to-income ratio with your debt-to-restriction ratio. Called their credit application ratio, this fee measures up the sum of the a beneficial borrower’s a fantastic charge card balance to their charge card constraints (that is, almost all their total readily available borrowing). This new DTL proportion suggests about what the quantity you may be maxing out your credit cards, while the DTI ratio computes your own month-to-month loans money as compared to the monthly income or other earnings.

Disgusting vs. Net gain

To own lending objectives, the debt-to-earnings computation is commonly predicated on gross income. Gross income is a before-income tax formula, definition its prior to taxes had been deducted out of your spend. Given that we do not reach continue the revenues (in most cases), we cannot invest those funds since you never in reality discovered they.