Deciding what kind of cash you might obtain having a zero doc financing is no easy accomplishment, as it is situated greatly with the lender’s testing of your complete financial situation

When you find yourself no doc loans can be easier and permit the majority of people so you can be eligible for a loan, they are available with many downsides. Zero doc funds together with normally require big off money and then have maximum borrowing restrictions which could make it difficult having individuals to help you obtain the amount of cash required.

As a whole, zero doc fund be a little more expensive than just old-fashioned fund, loans for bad credit in Compo and also the restriction loan amount that loan providers are able to accept can be lower than for typical fund. It is vital to keep in mind that no doc finance require no files of money or credit rating and this ensures that if you don’t be eligible for an excellent traditional mortgage on account of bad credit or if you is actually notice-employed and also have zero verifiable income, this really is a solution to consider.

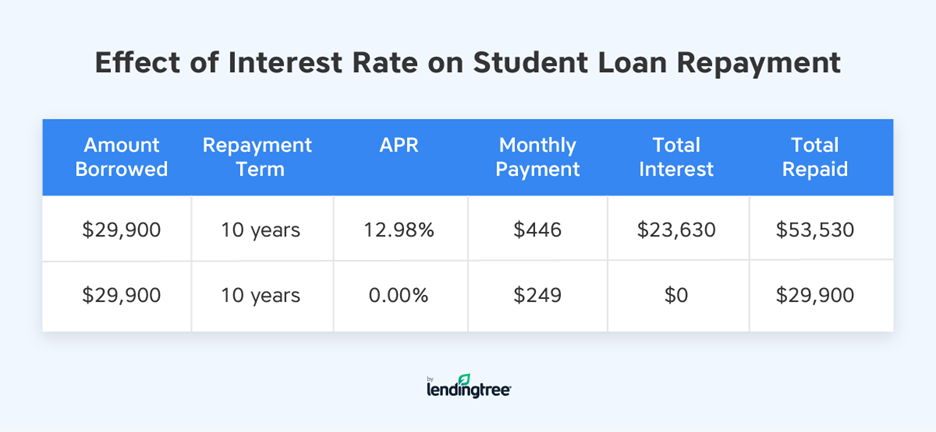

Generally, zero doc funds generally have higher rates than many other more conventional finance, considering the extra risk. That said, zero doctor money are still a fascinating option for individuals whom you want that loan without distribution documentation otherwise earnings confirmation files. The rate of interest differs from lender to lender and you may would depend out-of other variables such as your credit rating. To select the precise zero doc loan rate to you, get in touch with one of our zero doctor mortgage gurus now.

A no doctor mortgage is usually easier to qualify for than a traditional home loan, but has most will set you back. Fundamentally, no doctor money charges higher settlement costs and an enthusiastic origination fee. This new origination payment may vary with each bank, but if you check around you’ll find numerous aggressive zero doc mortgage now offers with no pre-percentage punishment without activities. And if the new borrower’s credit rating is reasonably an excellent, the interest rate could well be somewhat down.

Because the no doctor fund require quicker documentation than normal money, this new recognition processes takes much less big date. An average of, zero doc financing is going to be acknowledged in the a couple of days or quicker. When applying for instance financing, people should keep planned that more issues may be required to do their software, eg financial comments or any other proof financial balances. Therefore, you will need to ask potential lenders what data they will certainly need before app.

Being qualified getting a no doc financing can be the hassle-free financing service that you may need no money, zero resource documents expected. However, there are specific criteria to fulfill ahead of becoming eligible; this includes that have the absolute minimum credit history of 680 or more and at minimum 2 yrs away from documented cash supplies. In the event your borrowing from the bank is gloomier than just 680, specific lenders bring zero doctor finance which have option underwriting rules. Additionally, the loan number will be zero greater than 80% of your own appraised property value the home you want to to invest in for licensed no doc finance.

A no doctor financing is a wonderful option if you like to try to get a loan without the need to establish debt records. The application form process is relatively simple and will grab very little as one big date, with respect to the lender together with amount of cash being borrowed. You may have to bring some elementary advice such as facts of ID otherwise checking account facts when making an application for a zero doc loan, however, no thorough paper-trail is normally called for. Contact us today to obtain the techniques been.

Low doctor finance, additionally, will usually need some proof your earnings or expense and you will have some much more favorable conditions for those who have bad borrowing from the bank

A zero doctor financing does not require documentary proof of your own money or costs and is always designed for borrowers which have good good credit get. It difference between requirement form zero doctor finance was probably riskier getting lenders, and this can be of good use as you may have less paperwork however, on the flip side might also trigger large prices away from attract.