- Newest otherwise fairly questioned earnings otherwise assets (aside from the worth of the house or property protecting the loan), that affiliate often rely on to settle the loan;

- Current work condition (for folks who trust in a career money whenever evaluating an excellent member’s feature to repay the borrowed funds);

Additionally, the code and also the current CFPB Feature-to-Pay-off and you may Accredited Financial Signal Quick Organization Conformity Book give recommendations and you can examples of compatible solutions to assess, envision, and confirm each one of the significantly more than eight underwriting affairs. eleven

You are responsible for development and you will implementing underwriting criteria to suit your credit union and you will and also make alter to the people standards throughout the years inside reaction to empirical advice and you will switching economic or other conditions

a dozen You http://www.paydayloansconnecticut.com/long-hill/ should check out the ATR criteria in the context of the facts and you can issues relevant to their market, field of registration, your own borrowing commitment, and your people. In case your ideas your remark indicate you will find a difference when you look at the a member’s payment ability just after consummation (such as intentions to retire and never see the a position, otherwise plans to change from complete-time for you to area-go out functions), you must think that guidance. But not, you will possibly not inquire or verifications prohibited by the Controls B (Equivalent Borrowing Options Work). thirteen

Brand new ATR needs cannot exclude any sort of loan possess or deal systems. not, you might not build a safeguarded mortgage to a member in the event the that you do not generate a good, good-believe determination that representative is able to repay brand new loan. Therefore, if you underwrite finance which have nontraditional possess, such notice-simply otherwise bad-amortization episodes, you ought to thought an effective member’s capability to pay the borrowed funds just after the initial months. For highest-cost balloon money that do not qualify from an effective balloon-commission QM (chatted about later within this Regulating Alert), you ought to underwrite new balloon payment alone.

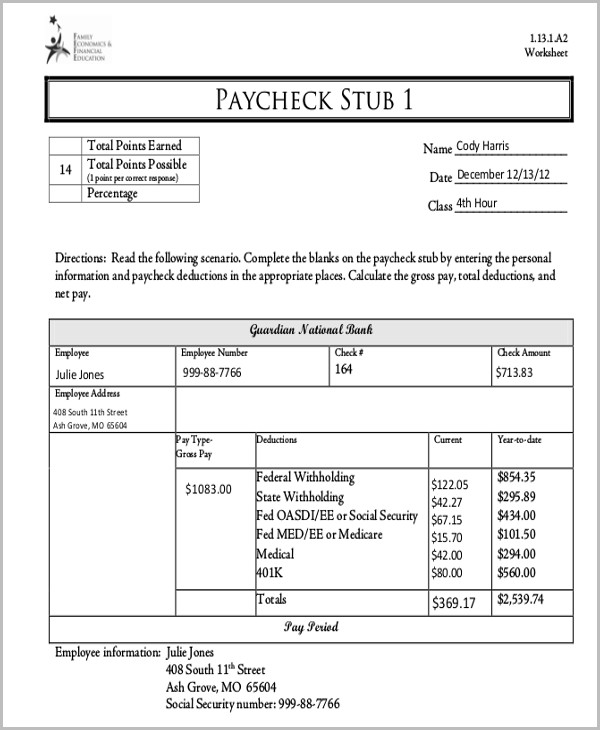

You should be sure all the info your have confidence in to really make the ATR devotion having fun with reasonably credible 3rd-party information. fourteen Such, you need to verify a member’s earnings having fun with files including W-2s otherwise payroll statements. You may need to trust associate-offered earnings records. These details are fairly legitimate 3rd-team ideas towards the total amount the ideal alternative party has actually examined them. 15

You must preserve facts you complied for the ATR/QM code for no less than three years once consummation. sixteen As you aren’t necessary to keep actual papers duplicates of documents found in underwriting that loan, you really must be in a position to reproduce eg facts truthfully.

Their conformity to the ATR conditions is dependent on the information readily available during origination off a shielded real estate loan. 17 That isn’t a violation of the ATR criteria if the a member you should never pay off a protected real estate loan solely because of a sudden and you may unexpected jobs loss when you originated the loan. The brand new ATR devotion pertains to suggestions identified during the or ahead of consummation.

If for example the credit partnership cannot already make certain the seven ATR underwriting items, you need to create or increase their verification, quality assurance, and you may conformity solutions consequently

On the other hand, the new rule brings one a member can bring an appropriate step up against a cards partnership less than TILA getting non-conformity toward ATR criteria. 18 As a result, when the professionals find it difficult settling secure finance your originate, they could allege you don’t build a good, good-faith determination of its capacity to pay-off before you can made the new loan. In the event the a part proves that it claim inside the courtroom, you may be accountable for, on top of other things, around 3 years of finance charge and you may costs the fresh user paid back, and the member’s judge charges. There is certainly a three-12 months law of constraints into ATR claims produced while the affirmative circumstances (direct says up against a creditor to possess problems to own an enthusiastic ATR pass). Immediately after 36 months, players results in ATR says just since a coverage to property foreclosure included in setoff otherwise recoupment states.