Value Generate Home isnt an effective cookie-cutter homebuilder. Actually, i strive is various other. I focus on strengthening individualized house on the end in NC , handling you against first compliment of closure. And we also can also be link you on the best mortgage brokers for the the industry, too!

Selecting the most appropriate financial for the disease are a life threatening part of homebuilding process. We shall help you compliment of each step within this techniques, having fun with our the means to access the brand new design financing advantages so you can get the best financial support package you are able to to help you make your fantasy household.

How to Be eligible for a mortgage into the North carolina

Vermont even offers some apps giving pointers, financial help, and other resources. Part of the exactly what you need to-do try: step one.) know very well what you really can afford, and you will dos.) know what kind of funds you could potentially be eligible for.

Regarding understanding how far house you really can afford, just remember that , in addition to buying the domestic, you ought to have currency set aside to possess maintenance & fixes, tools, and you can issues. And, lenders favor a financial obligation-to-income proportion less than 42%, therefore you’ll want to make pay day loan Indiana sure you provides only a small amount loans as you are able to.

There are a number regarding a means to money a property within the NC, and additionally FHA loans, traditional funds, and you may gives. (The newest Vermont Homes Finance Service features helped thousands of Northern Carolinians inside to buy property which have a wide range of financing solutions one to generate to purchase another domestic affordable!)

Before you will do anything else, it is essential to understand in which their borrowing really stands. Don’t know exactly what your credit score are? Look at the credit score free of charge which have Experian. If for example the credit rating is actually 620 or more, you should have a chance from the bringing recognized getting a traditional mortgage.

FHA loans are great for anybody and you may family members which have reduced so you can modest income and less-than-primary credit scores. They are backed by the newest Government Homes Management (FHA), and may even make it easier to qualify for a house in the event you perhaps not fulfill other criteria.

Traditional financing (fixed-speed, adjustable-speed, conforming, non-conforming) are funds that aren’t backed by an authorities company. Antique mortgages always need to see down payment and you may money criteria put by the Federal national mortgage association and Freddie Mac computer, and you will follow mortgage limitations set of the Government Construction Financing Management (FHFA).

To own research: The fresh new down-payment into the a keen FHA financing was a lot less than just a traditional mortgage, constantly only about step three.5 per cent. Whenever you are a conventional loan commonly demands a get out-of 620 or more than, which have a keen FHA financing, you merely you need a score of at least 580 in order to be considered. If for example the rating try ranging from 500 and you can 579, you might still be able to get a keen FHA financing when the you add 10% off.

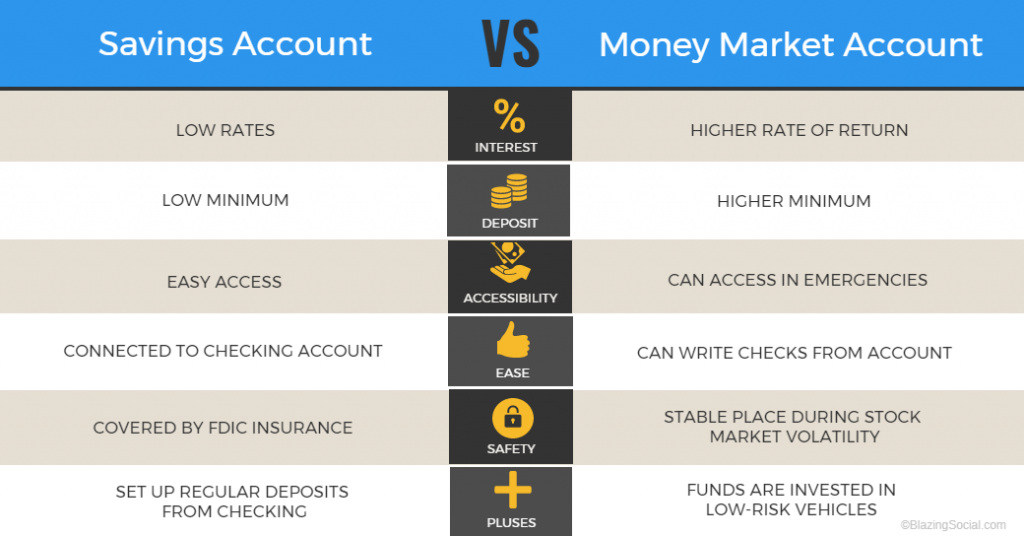

Government-recognized finance (FHA, Virtual assistant, USDA) are helpful without having great borrowing from the bank otherwise a big down payment. But if you has a good credit score otherwise can also be set more funds down, a normal financing is likely a better choices. (The more currency you place off, the lower your own mortgage payment would-be!) Compare various solutions as well as their advantages & cons to discover the best loan for your requirements.

Is Financing another type of Build Home Different from good Used House?

With techniques, resource a special structure house is like providing home financing to purchase a resale family. But you will find several differences. For example, developers of the latest construction belongings (eg Worth Generate Property!) can offer resource bundles, often physically compliment of our own home loan subsidiary or a dependable regional lender .

Concurrently, there are novel financing you to connect with the brand new homes yet not to help you resales, such link loans and you will the fresh new-structure financial support. These are always funds the acquisition and construction of an excellent new home until the sales of your own latest household.

When choosing a lender, need somebody who knows and will assist you from the fresh new framework procedure, make you mortgage selection, and help you decide on one which provides your financial needs. Instance, they’re able to make it easier to check if you need a construction financing.

Build loans money the building of the property. While you are building a totally bespoke home , you want a homes financing to afford price of the information and you will labor to construct our home one which just take it. He or she is brief-term funds, and are located in more differences, like Framework-Merely otherwise Structure-to-Long lasting. An experienced lender should be able to make it easier to determine simple tips to pay for property in NC.

Tips Financing Property inside the NC

With respect to money property within the NC, the more educated and you will prepared you are, quicker and simpler it could be. Gather their information in advance, discover your credit rating, brush through to different financial support solutions, and select just the right bank for your disease. Label (919) 300-4923 otherwise call us to learn more about the money selection with Really worth Make Belongings.