A predetermined-rates home loan is a kind of home loan for which brand new interest rate is set when you take from loan and you will it does not transform inside term of one’s loan.

Forbearance

Forbearance occurs when your own servicer permits you briefly to invest your own financial during the a lesser price or temporarily to prevent investing your own mortgage. Your own servicer ple, you recently destroyed your job, experienced a disaster, or away from a condition otherwise injury one to enhanced your quality of life worry costs. Forbearance is a kind of losings mitigation.

You need to speak to your loan servicer to consult forbearance. Keep in mind that you’re going to have to make up this type of skipped or less costs if your forbearance months is more than.

Force-set insurance policies

Their servicer might need force-placed insurance coverage if you not have the insurance coverage or if your coverage will not fulfill their servicer’s requirements. Force-set insurance rates constantly protects precisely the bank, maybe not you. New servicer will charge a fee with the insurance coverage. Force-place insurance policy is usually more expensive than selecting an agenda oneself.

Property foreclosure

Foreclosure happens when the lending company or servicer takes straight back property after the citizen fails to make home loan repayments. In some says, the lending company should head to judge so you can title loan New York foreclose on your property (official foreclosure), however, other states do not require a judge processes (non-judicial foreclosures). Generally, consumers should be notified should your financial otherwise servicer begins property foreclosure procedures. Federal laws could possibly get apply to in the event that property foreclosure can start.While you are concerned about property foreclosure, understand how to rating let.

Freddie Mac computer

The Federal Mortgage Mortgage Agency (Freddie Mac computer) try an exclusive firm built by Congress. Its objective is to try to render balances and you will affordability in the houses market by purchasing mortgage loans out of banking companies and other mortgage producers. This provider is currently less than conservatorship, underneath the recommendations of your Federal Housing Funds Service (FHFA).

Good-faith Imagine

A good-faith Guess (GFE) try a type you to definitely a loan provider need to leave you after you apply for a face-to-face home loan. The fresh new GFE listings first information about the fresh new terms of the opposite mortgage loan offer.

Government tape costs

Regulators tape costs is actually costs analyzed by the county and you will state agencies to possess legally recording the action, mortgage and you will files linked to your property mortgage.

Higher-valued mortgage

In general, a higher-cost home loan is the one which have an annual percentage rate, otherwise Apr, greater than a benchmark speed called the Mediocre Best Promote Rate. Find out more

HOA dues

When you are interested in to invest in a condo, co-op, otherwise a house in a fully planned subdivision or other arranged neighborhood with mutual attributes, you usually have to pay condo charges or Homeowners’ Relationship (HOA) expenses. This type of fees vary generally. Condominium otherwise HOA charges are usually paid individually from the month-to-month mortgage payment. Unless you pay these fees, you could face debt collection efforts from the homeowner’s association and you can actually foreclosure.

Family appraisal

An assessment try a created document that shows a viewpoint from simply how much a home may be worth. Brand new assessment gives you useful information in regards to the assets. It makes reference to what makes they rewarding that can tell you the way it compares to other functions locally. An assessment try another assessment of one’s worth of the brand new assets.

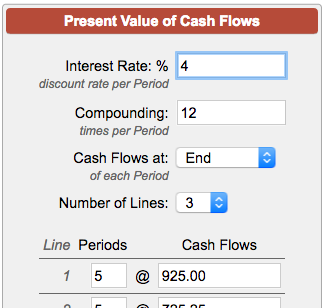

Domestic equity personal line of credit (HELOC)

Property guarantee line of credit (HELOC) is a personal line of credit that allows one to borrow on your residence collateral. Equity is the matter your home is currently really worth, without the level of people home loan on your property. As opposed to property guarantee mortgage, HELOCs normally have varying rates of interest. For the majority of HELOCs, you are going to discover special inspections or a credit card, and you will borrow money having a designated go out from the time you open your account. This time around period is named the brand new draw period. Within the draw months, you can borrow money, therefore need build minimal costs. When the mark period closes, so long as manage to borrow money from the credit line. After the mark months closes you’re expected to pay-off your debts all at the same time or you could be allowed to repay more a particular time period. If you’re unable to pay back the fresh HELOC, the lending company you can expect to foreclose in your family.