Across the 49 billion us americans, they keep a total of $step 1.step three trillion cash during the education loan personal debt. Borrowers every-where seek methods to influence how to deal with education loan fees. To have students exactly who including happen to be residents all the questions try; would it be in your best interest to refinance your house so you can pay back your student loans, or is student loan refinancing the better choice. The clear answer, needless to say, would it be would depend.

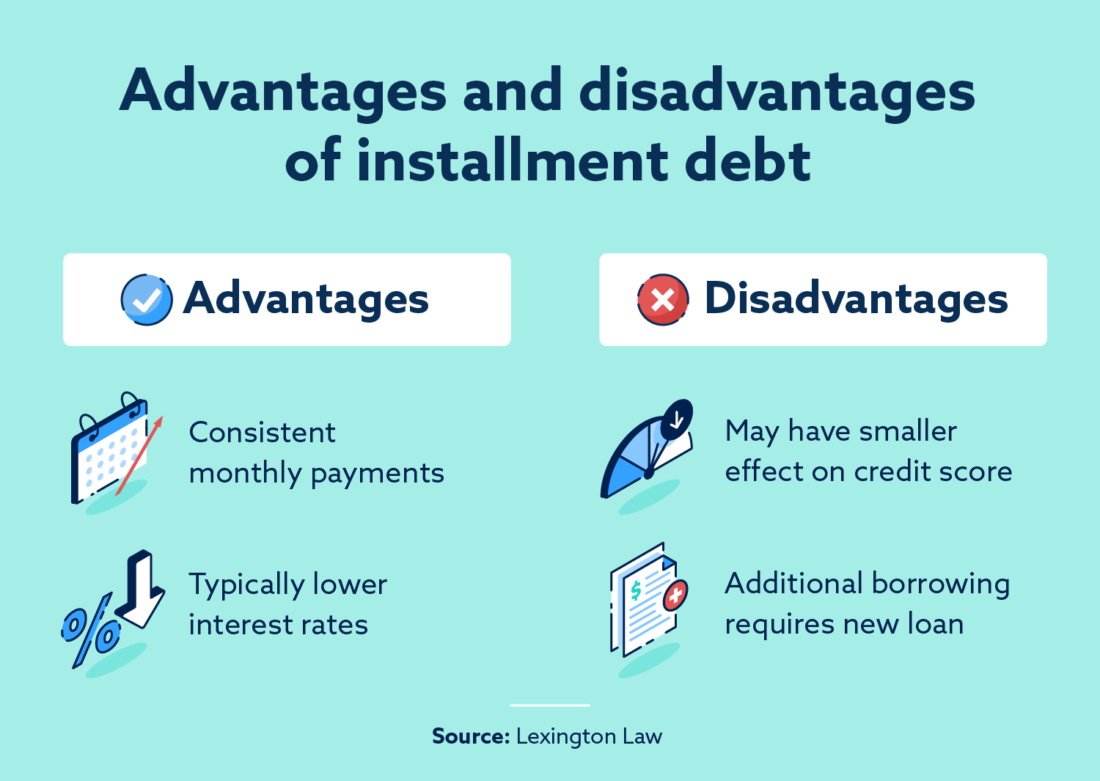

Mortgage refinance software basically create individuals to exchange one to personal debt for the next (student loan obligations getting home loan obligations) if you’re student loan refinancing lets consumers to get a completely new loan with a separate interest. The benefits and detriments lay during the even though your own house’s worthy of helps lender’s standards, and you may even in the event you’ll be able to in reality manage to safer a beneficial straight down rate of interest.

Must i re-finance my personal student loans?

Placing your house at stake is a life threatening chance, even though you could potentially refinance your home that have the absolute minimum borrowing rating regarding 620 , you might rating a much better speed courtesy student loan refinancing which have a top credit score. Student loan refinancing cost are based on your credit rating, if you enjoys good credit this can be the secure and higher option, and you will produce significantly down payments . This one isnt offered through the authorities, merely thanks to private lenders; not, you could potentially refinance the federal money playing with a personal bank.

Refinancing was recommended getting individuals with individual fund that has minimal borrowing from the bank otherwise bad credit when earliest resource scholar financing, but have since mainly based far more credit score and also an excellent score. A poor credit records or lower credit rating enables you to an effective high-exposure debtor and typically result in high interest levels, while additional history and you may a heightened score could potentially trigger a good refinance that have a lower life expectancy rates.

Having government loan individuals, sometimes after you grabbed out your funds is the deciding reason behind whether or not private refinancing is a great solution to you personally. Federal student loan rates of interest strike historic lows up to 2013, and you can a refinance bring most likely may not be aggressive. But not, for individuals who borrowed when you look at the preceding decades in the highest rates, and also have excellent borrowing, you are capable qualify so you can refinance within a reduced rates.

Prior to considering education loan refinancing, bear in mind you’ll eliminate specific positives that comes with government student finance including Earnings-Founded repayment. Although not, predicated on , when you have a secure job, discounts to own an emergency, a powerful credit rating and you will most likely wouldn’t make the most of forgiveness mainly based options, it is worth taking into consideration just what student loan refinancing perform for you.

Ought i re-finance my house?

A finances-aside re-finance is yet another approach to take throughout the combatting obligations. It allows that turn the house equity you’ve built up to your dollars which you can use to possess anything you such as. The majority of people put it to use to pay for high instructions or pay back loans.

As the home values continue to increase, family guarantee money get potential sourced elements of bucks to own home owners. Regardless of if financial cost has actually found slightly about latest months, they however are over the years low, towards the 31-seasons fixed-rate mediocre within step 3.97 % . To possess homeowners looking to reduce its payment, such https://paydayloancolorado.net/eaton/ reasonable prices make for an effective possibility to refinance. They’re able to along with help to clean out large-attention credit debt, given that almost ten commission facts separate the average charge card interest from the mediocre 29-seasons home loan rate.

Although this could well be an incredibly much easier option for particular, it is critical to believe many facts before you make this decision. To own elderly homeowners that have way more house equity, this type of refinancing to settle figuratively speaking will make experience beneath the proper activities. Echoing this type of attitude is actually Rohit Chopra, an elderly fellow at Consumer Federation away from America : Individuals with a lot of household security can often rating home loan prices which can be drastically below the speed on their beginner financing… The brand new property owners may not have as frequently to gain, and are in the an elevated exposure when considering moving the pupil money with the home loan. That being said, it doesn’t matter who new debtor try, it’s important to thoroughly imagine specific circumstances before choosing to make use of domestic guarantee to settle college loans.

Very first, in the event the rates are lower, your home is essentially at stake . Lenders provide a lower life expectancy interest as they have a legal state they your residence or even pay. If you can’t spend, could result in into the foreclosures. Although this is inherent in all mortgages, raising the count you borrowed from on the house do continue brand new period of time your residence might possibly be acting as shelter for the debt.

2nd, you are letting go of alternative repayment choice and you can forgiveness benefits into government fund. Federal figuratively speaking possess ranged defenses plus Earnings-Based Installment (IBR) . Although not, when domestic guarantee can be used to pay off expenses costs, these types of experts no longer exists. Additionally it is important to consider the perception refinancing to settle college loans might have in your taxation. You could allege a total of $2,500 inside deductions having student loan appeal. To the contrary, the loan appeal deduction has actually a higher restriction and will mean a greater tax work with in cases of large income earners. New $2,500 deduction (which can simply totally be stated if for example the adjusted gross income are below $65,000 ) is perfect for children and you may latest grads, but could not be beneficial to people throughout the associates whoever gross income is higher than that it profile. It is best to request a taxation coach to look at various selection. Make sure you thoroughly lookup as well as have remedies for these issues if you re-finance your loans.

Long lasting payment or refinancing alternatives you’re considering it is important to understand what you would be stopping otherwise gaining throughout the procedure and you will cautiously check what you’re economically capable afford.